Direxion

Shares ETF Trust

Prospectus

|

1301

Avenue of the Americas (6th Avenue), 28th Floor |

New

York, New York 10019 |

(866)

476-7523 |

www.direxion.com

|

2X

BULL FUNDS |

2X

BEAR FUNDS |

|

Direxion Daily S&P

500® Bull 2X Shares

(SPUU) |

|

|

Direxion Daily MSCI Brazil

Bull 2X Shares (BRZU) |

|

|

Direxion Daily CSI 300 China

A Share Bull 2X Shares (CHAU) |

|

|

Direxion Daily CSI China

Internet Index Bull 2X Shares (CWEB) |

|

|

Direxion Daily MSCI India

Bull 2X Shares (INDL) |

|

|

Direxion Daily Russia Bull

2X Shares (RUSL) |

|

|

Direxion Daily 5G

Communications Bull 2X Shares (TENG) |

Direxion Daily 5G

Communications Bear 2X Shares |

|

Direxion Daily Aviation Bull

2X Shares |

Direxion Daily Aviation Bear

2X Shares |

|

Direxion Daily Cloud

Computing Bull 2X Shares (CLDL) |

Direxion Daily Cloud

Computing Bear 2X Shares (CLDS) |

|

Direxion Daily Energy Bull

2X Shares (ERX) |

Direxion Daily Energy Bear

2X Shares (ERY) |

|

Direxion Daily FinTech Bull

2X Shares (FNTC) |

Direxion Daily FinTech Bear

2X Shares |

|

Direxion Daily Global Clean

Energy Bull 2X Shares (KLNE) |

Direxion Daily Global Clean

Energy Bear 2X Shares |

|

Direxion Daily Gold Miners

Index Bull 2X Shares (NUGT) |

Direxion Daily Gold Miners

Index Bear 2X Shares (DUST) |

|

Direxion Daily Junior Gold

Miners Index Bull 2X Shares (JNUG) |

Direxion Daily Junior Gold

Miners Index Bear 2X Shares (JDST) |

|

Direxion Daily Metal Miners

Bull 2X Shares (MNM) |

Direxion Daily Metal Miners

Bear 2X Shares |

|

Direxion Daily S&P Oil

& Gas Exp. & Prod. Bull 2X Shares (GUSH) |

Direxion Daily S&P Oil

& Gas Exp. & Prod. Bear 2X Shares (DRIP) |

|

Direxion Daily Oil Services

Bull 2X Shares (ONG) |

Direxion Daily Oil Services

Bear 2X Shares |

|

Direxion Daily Rare

Earth/Strategic Metals Bull 2X Shares |

Direxion Daily Rare

Earth/Strategic Metals Bear 2X Shares |

|

Direxion Daily Robotics,

Artificial Intelligence & Automation

Index Bull 2X Shares

(UBOT) |

|

|

Direxion Daily Select Large

Caps & FANGs Bull 2X Shares (FNGG) |

Direxion Daily Select Large

Caps & FANGs Bear 2X Shares |

|

Direxion Daily Software Bull

2X Shares (SWAR) |

Direxion Daily Software Bear

2X Shares |

|

Direxion Daily S&P

500® Equal Weight Bull 2X Shares

(EVEN) |

Direxion Daily S&P

500® Equal Weight Bear 2X

Shares |

|

Direxion Daily S&P

500® Pure Growth Bull 2X

Shares |

Direxion Daily S&P

500® Pure Growth Bear 2X

Shares |

|

Direxion Daily S&P

500® Pure Value Bull 2X

Shares |

Direxion Daily S&P

500®

Pure Value Bear

2X Shares |

|

Direxion Daily Travel &

Vacation Bull 2X Shares (OOTO) |

Direxion Daily Travel &

Vacation Bear 2X Shares |

|

Direxion Daily US

Infrastructure Bull 2X Shares (DOZR) |

Direxion Daily US

Infrastructure Bear 2X Shares |

February 28,

2022

The

shares offered in this prospectus (each a “Fund” and collectively the “Funds”)

are, or upon commencement of operations will be, listed

and traded on the NYSE Arca, Inc.

The

Funds seek daily

leveraged investment

results and are intended to be used as short-term trading vehicles. Each Fund

with “Bull” in its name attempts to provide daily investment results that

correspond to two times the performance of an underlying index and are

collectively referred to as the “Bull Funds.” Each Fund with “Bear” in its name

attempts to provide daily investment results that correspond to two times the

inverse (or opposite) of the performance of an underlying index and are

collectively referred to as the “Bear Funds.”

The

Funds are not intended to be used by, and are not appropriate for, investors who

do not intend to actively monitor and manage their

portfolios. The Funds are very different from most mutual funds and

exchange-traded funds. Investors should note that:

(1)

The

Funds pursue daily

leveraged

investment objectives, which means that the Funds are riskier than alternatives

that do not use leverage because the Funds magnify the performance of their

underlying index.

(2)

Each

Bear Fund pursues a daily

leveraged

investment objective that is inverse

to

the performance of its underlying index, a result opposite of most mutual funds

and exchange-traded funds.

(3)

The

pursuit of daily investment objectives means that the return of a Fund for a

period longer than a full trading day will be the product of a series of daily

leveraged returns for each trading day during the relevant period. As a

consequence, especially in periods of market volatility, the volatility of the

underlying index may affect a Fund’s return as much as, or more than, the return

of the underlying index. Further, the return for investors that invest for

periods less than a full trading day will not be the product of the return of a

Fund’s stated daily leveraged investment objective and the performance of the

underlying index for the full trading day. During periods of high volatility,

the Funds may not perform as expected and the Funds may have losses when an

investor may have expected gains if the Funds are held for a period that is

different than one trading day.

The

Funds are not suitable for all investors. The Funds are designed to be utilized

only by sophisticated investors, such as traders and

active investors employing dynamic strategies. Investors in the Funds

should:

(a)

understand

the risks associated with the use of leverage;

(b)

understand

the consequences of seeking daily leveraged investment

results;

(c)

for each Bear

Fund, understand the risk of shorting; and

(d)

intend

to actively monitor and manage their investments.

Investors

who do not understand the Funds, or do not intend to actively manage their funds

and monitor their investments, should

not buy the Funds.

There

is no assurance that any Fund will achieve its investment objective and an

investment in a Fund could lose money. No single Fund

is a complete investment program.

If

a Fund’s underlying index moves more than 50% on a given trading day in a

direction adverse to the Fund, the Fund’s investors would lose all

of their money. The Funds’ investment adviser, Rafferty Asset Management, LLC,

will attempt to position each Fund’s portfolio to ensure that a Fund does not

gain or lose more than 90% of its net asset value on a given trading day. As a

consequence, a Fund’s portfolio should not be responsive to underlying index

movements beyond 45% on a given trading day, whether that movement is favorable

or adverse to the Fund. For example, if a Bull Fund’s underlying index was to

gain 50% on a given trading day, that Fund should be limited to a gain of 90%

for that day, which corresponds to 200% of an underlying index gain of 45%,

rather than 200% of an underlying index gain of 50%.

These

securities have not been approved or disapproved by the U.S. Securities and

Exchange Commission (“SEC”) or the U.S. Commodity Futures

Trading Commission (“CFTC”), nor have the SEC or CFTC passed upon the adequacy

of this Prospectus. Any representation to the contrary is a criminal

offense.

Table

of Contents

|

1 | |

|

1 | |

|

9 | |

|

18 | |

|

28 | |

|

37 | |

|

46 | |

|

56 | |

|

64 | |

|

73 | |

|

81 | |

|

90 | |

|

98 | |

|

106 | |

|

114 | |

|

123 | |

|

131 | |

|

139 | |

|

149 | |

|

159 | |

|

168 | |

|

178 | |

|

187 | |

|

197 | |

|

205 | |

|

213 | |

|

221 | |

|

230 | |

|

238 | |

|

246 | |

|

255

|

|

265 | |

|

274 | |

|

282 | |

|

290 | |

|

298 | |

|

306 | |

|

313 | |

|

321 | |

|

329 | |

|

337 | |

|

344 | |

|

352 | |

|

360 | |

|

368 | |

|

376 | |

|

384 | |

|

386 | |

|

395 | |

|

Other Risks

of the Funds |

422 |

|

425 | |

|

425 | |

|

426 | |

|

427 | |

|

429 | |

|

429 | |

|

429 | |

|

429 | |

|

431 | |

|

432 | |

|

435 | |

|

Back

Cover |

Summary

Section

Important

Information Regarding the Fund

The Direxion

Daily S&P 500® Bull 2X Shares (the “Fund”)

seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the S&P

500® Index (the "Index"). The return

for investors that invest for periods longer or shorter than a trading day

should not be expected to be 200% of the performance of the Index for the

period. The return of the Fund for a period longer than a trading day will be

the result of each trading day’s compounded return over the period, which will

very likely differ from 200% of the return of the Index for that period. Longer

holding periods, higher volatility of the Index and leverage increase the impact

of compounding on an investor’s returns. During periods of higher Index

volatility, the volatility of the Index may affect the Fund’s return as much as,

or more than, the return of the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

|

Expense

Cap/Reimbursement(2)

|

- |

|

Total

Annual Fund Operating Expenses After

Expense

Cap/Reimbursement |

|

(1)

(2)

|

1 Year |

3

Years |

5

Years |

10

Years |

|

$ |

$ |

$ |

$ |

1

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

2

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

4

5

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

6

|

|

1 Year |

5

Years |

Since

Inception

5/28/2014 |

|

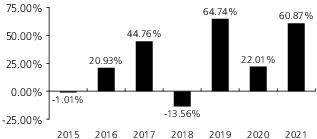

Return

Before Taxes |

60.87% |

32.25% |

25.64% |

|

Return

After Taxes on

Distributions |

58.91% |

29.90% |

23.33% |

|

Return

After Taxes on

Distributions

and Sale of

Fund

Shares |

36.07% |

25.62% |

20.42% |

|

S&P

500®

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

28.71% |

18.47% |

14.98% |

Management

Investment

Adviser. Rafferty Asset

Management, LLC

is

the Fund’s investment adviser.

Portfolio

Managers. The following

members of Rafferty’s investment team are jointly and primarily responsible for

the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of

Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception in

May

2014 |

Portfolio

Manager |

|

Tony

Ng |

Since

September

2015 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The

Fund’s individual shares may only be purchased or sold in the secondary

market through a broker-dealer or other financial intermediaries at market price

rather than at net asset value. The market price of Shares will fluctuate in

response to changes in the value of the Fund’s holdings and supply and demand

for the Shares, which may result in shareholders purchasing or selling the

Shares on the secondary market at a market price that is greater than net asset

value (a premium) or less than net asset value (a discount). A shareholder may

incur costs attributable to the difference between the highest price a buyer is

willing to pay for the Fund’s Shares (bid) and the lowest price a seller is

willing to accept for the Fund’s Shares (ask) when buying or selling Shares on

the secondary market (the “bid-ask spread”) in addition to brokerage

commissions. The bid-ask spread may vary over time for Shares based on trading

volume and market liquidity. Recent information regarding the Fund Shares such

as net asset value, market price, premiums and discounts and bid-ask spreads and

related other information is available on the Fund’s website,

www.direxion.com/etfs?producttab=performance.

The

Fund’s shares are not individually redeemable by the Fund. The Fund

will issue and redeem Shares only to Authorized Participants in exchange for

cash or a deposit or delivery of a basket of assets (securities and/or cash) in

large blocks, known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The

Fund intends to make distributions that may be taxed as ordinary

income or long-term capital gains. Those distributions will be subject to

federal income tax and may also be subject to state and local taxes, unless you

are investing through a tax-deferred arrangement, such as a 401(k) plan

7

Direxion

Shares ETF Trust Prospectus

or

an individual retirement account. Distributions or investments made

through tax-deferred arrangements may be taxed later upon withdrawal.

Distributions by the Fund may be significantly higher than those of most other

ETFs.

Payments

to Broker-Dealers and Other Financial Intermediaries

If

you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank or financial advisor), the Fund and/or

its Adviser may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

Index

Information

The

“S&P 500® Index” is a

product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for

use by Rafferty. Standard & Poor’s® and

S&P® are registered

trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow

Jones® is a registered

trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these

trademarks have been licensed for use by SPDJI and sublicensed for certain

purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or

promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none

of such parties make any representation regarding the advisability of investing

in such product(s) nor do they have any liability for any errors, omissions, or

interruptions of the S&P 500®

Index.

Direxion

Shares ETF Trust Prospectus

8

Important

Information Regarding the Fund

The Direxion

Daily MSCI Brazil Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the MSCI

Brazil 25/50 Index (the "Index"). The return for investors that invest for

periods longer or shorter than a trading day should not be expected to be 200%

of the performance of the Index for the period. The return of the Fund for a

period longer than a trading day will be the result of each trading day’s

compounded return over the period, which will very likely differ from 200% of

the return of the Index for that period. Longer holding periods, higher

volatility of the Index and leverage increase the impact of compounding on an

investor’s returns. During periods of higher Index volatility, the volatility of

the Index may affect the Fund’s return as much as, or more than, the return of

the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

(1)

|

1 Year |

3

Years |

5

Years |

10

Years |

|

$ |

$ |

$ |

$ |

9

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

10

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

12

13

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

14

15

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

16

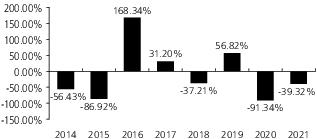

|

|

1 Year |

5

Years |

Since

Inception

4/10/2013 |

|

Return

Before Taxes |

-39.32% |

-41.61% |

-45.18% |

|

Return

After Taxes on

Distributions |

-40.12% |

-41.89% |

-45.31% |

|

Return

After Taxes on

Distributions

and Sale of

Fund

Shares |

-22.71% |

-21.70% |

-14.99% |

|

MSCI

Brazil 25/50 Index

(reflects

no deduction for

fees,

expenses or taxes) |

-16.95% |

0.80% |

-3.59% |

|

S&P

500®

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

28.71% |

18.47% |

15.82% |

Management

Investment

Adviser. Rafferty Asset

Management, LLC

is

the Fund’s investment adviser.

Portfolio

Managers. The following

members of Rafferty’s investment team are jointly and primarily responsible for

the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of

Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception in

May

2013 |

Portfolio

Manager |

|

Tony

Ng |

Since

September

2015 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The

Fund’s individual shares may only be purchased or sold in the secondary

market through a broker-dealer or other

financial

intermediaries at market price rather than at net asset value. The

market price of Shares will fluctuate in response to changes in the value of the

Fund’s holdings and supply and demand for the Shares, which may result in

shareholders purchasing or selling the Shares on the secondary market at a

market price that is greater than net asset value (a premium) or less than net

asset value (a discount). A shareholder may incur costs attributable to the

difference between the highest price a buyer is willing to pay for the Fund’s

Shares (bid) and the lowest price a seller is willing to accept for the Fund’s

Shares (ask) when buying or selling Shares on the secondary market (the “bid-ask

spread”) in addition to brokerage commissions. The bid-ask spread may vary over

time for Shares based on trading volume and market liquidity. Recent information

regarding the Fund Shares such as net asset value, market price, premiums and

discounts and bid-ask spreads and related other information is available on the

Fund’s website, www.direxion.com/etfs?producttab=performance.

The

Fund’s shares are not individually redeemable by the Fund. The Fund

will issue and redeem Shares only to Authorized Participants in exchange for

cash or a deposit or delivery of a basket of assets (securities and/or cash) in

large blocks, known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The

Fund intends to make distributions that may be taxed as ordinary

income or long-term capital gains. Those distributions will be subject to

federal income tax and may also be subject to state and local taxes, unless you

are investing through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account. Distributions or investments made through

tax-deferred arrangements may be taxed later upon withdrawal. Distributions by

the Fund may be significantly higher than those of most other ETFs.

Payments

to Broker-Dealers and Other Financial Intermediaries

If

you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank or financial advisor), the Fund and/or

its Adviser may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

17

Direxion

Shares ETF Trust Prospectus

Important

Information Regarding the Fund

The Direxion

Daily CSI 300 China A Share Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the CSI 300

Index (the "Index"). The return for investors that invest for periods longer or

shorter than a trading day should not be expected to be 200% of the performance

of the Index for the period. The return of the Fund for a period longer than a

trading day will be the result of each trading day’s compounded return over the

period, which will very likely differ from 200% of the return of the Index for

that period. Longer holding periods, higher volatility of the Index and leverage

increase the impact of compounding on an investor’s returns. During periods of

higher Index volatility, the volatility of the Index may affect the Fund’s

return as much as, or more than, the return of the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

(1)

|

1 Year |

3

Years |

5

Years |

10

Years |

|

$ |

$ |

$ |

$ |

Direxion

Shares ETF Trust Prospectus

18

19

Direxion

Shares ETF Trust Prospectus

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direxion

Shares ETF Trust Prospectus

20

21

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

22

23

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

24

25

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

26

|

|

1 Year |

5

Years |

Since

Inception

4/16/2015 |

|

Return

Before Taxes |

-2.82% |

19.49% |

0.48% |

|

Return

After Taxes on

Distributions |

-3.46% |

19.21% |

0.31% |

|

Return

After Taxes on

Distributions

and Sale of

Fund

Shares |

-1.65% |

15.78% |

0.29% |

|

CSI

300 Index (reflects

no

deduction

for fees,

expenses

or taxes) |

-1.23% |

12.30% |

3.32% |

|

S&P

500®

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

28.71% |

18.47% |

15.13% |

Management

Investment

Adviser. Rafferty Asset

Management, LLC

is

the Fund’s investment adviser.

Portfolio

Managers. The following

members of Rafferty’s investment team are jointly and primarily responsible for

the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of

Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception in

April

2015 |

Portfolio

Manager |

|

Tony

Ng |

Since

September

2015 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The

Fund’s individual shares may only be purchased or sold in the secondary

market through a broker-dealer or other

financial

intermediaries at market price rather than at net asset value. The

market price of Shares will fluctuate in response to changes in the value of the

Fund’s holdings and supply and demand for the Shares, which may result in

shareholders purchasing or selling the Shares on the secondary market at a

market price that is greater than net asset value (a premium) or less than net

asset value (a discount). A shareholder may incur costs attributable to the

difference between the highest price a buyer is willing to pay for the Fund’s

Shares (bid) and the lowest price a seller is willing to accept for the Fund’s

Shares (ask) when buying or selling Shares on the secondary market (the “bid-ask

spread”) in addition to brokerage commissions. The bid-ask spread may vary over

time for Shares based on trading volume and market liquidity. Recent information

regarding the Fund Shares such as net asset value, market price, premiums and

discounts and bid-ask spreads and related other information is available on the

Fund’s website, www.direxion.com/etfs?producttab=performance.

The

Fund’s shares are not individually redeemable by the Fund. The Fund

will issue and redeem Shares only to Authorized Participants in exchange for

cash or a deposit or delivery of a basket of assets (securities and/or cash) in

large blocks, known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The

Fund intends to make distributions that may be taxed as ordinary

income or long-term capital gains. Those distributions will be subject to

federal income tax and may also be subject to state and local taxes, unless you

are investing through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account. Distributions or investments made through

tax-deferred arrangements may be taxed later upon withdrawal. Distributions by

the Fund may be significantly higher than those of most other ETFs.

Payments

to Broker-Dealers and Other Financial Intermediaries

If

you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank or financial advisor), the Fund and/or

its Adviser may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

27

Direxion

Shares ETF Trust Prospectus

Important

Information Regarding the Fund

The Direxion

Daily CSI China Internet Index Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the CSI

Overseas China Internet Index (the "Index"). The return for investors that

invest for periods longer or shorter than a trading day should not be expected

to be 200% of the performance of the Index for the period. The return of the

Fund for a period longer than a trading day will be the result of each trading

day’s compounded return over the period, which will very likely differ from 200%

of the return of the Index for that period. Longer holding periods, higher

volatility of the Index and leverage increase the impact of compounding on an

investor’s returns. During periods of higher Index volatility, the volatility of

the Index may affect the Fund’s return as much as, or more than, the return of

the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

(1)

|

1 Year |

3

Years |

5

Years |

10

Years |

|

$ |

$ |

$ |

$ |

Direxion

Shares ETF Trust Prospectus

28

29

Direxion

Shares ETF Trust Prospectus

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direxion

Shares ETF Trust Prospectus

30

31

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

32

33

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

34

35

Direxion

Shares ETF Trust Prospectus

|

|

1 Year |

5

Years |

Since

Inception

11/2/2016 |

|

Return

Before Taxes |

-79.35% |

-7.71% |

-11.71% |

|

Return

After Taxes on

Distributions |

-79.35% |

-8.07% |

-12.04% |

|

Return

After Taxes on

Distributions

and Sale of

Fund

Shares |

-46.97% |

-5.52% |

-8.22% |

|

CSI

Overseas China Internet

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

-48.98% |

3.69% |

1.33% |

|

S&P

500®

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

28.71% |

18.47% |

19.28% |

Management

Investment

Adviser. Rafferty Asset

Management, LLC

is

the Fund’s investment adviser.

Portfolio

Managers. The following

members of Rafferty’s investment team are jointly and primarily responsible for

the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of

Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception in

November

2016 |

Portfolio

Manager |

|

Tony

Ng |

Since

Inception in

November

2016 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The

Fund’s individual shares may only be purchased or sold in the secondary

market through a broker-dealer or other

financial

intermediaries at market price rather than at net asset value. The

market price of Shares will fluctuate in response to changes in the value of the

Fund’s holdings and supply and demand for the Shares, which may result in

shareholders purchasing or selling the Shares on the secondary market at a

market price that is greater than net asset value (a premium) or less than net

asset value (a discount). A shareholder may incur costs attributable to the

difference between the highest price a buyer is willing to pay for the Fund’s

Shares (bid) and the lowest price a seller is willing to accept for the Fund’s

Shares (ask) when buying or selling Shares on the secondary market (the “bid-ask

spread”) in addition to brokerage commissions. The bid-ask spread may vary over

time for Shares based on trading volume and market liquidity. Recent information

regarding the Fund Shares such as net asset value, market price, premiums and

discounts and bid-ask spreads and related other information is available on the

Fund’s website, www.direxion.com/etfs?producttab=performance.

The

Fund’s shares are not individually redeemable by the Fund. The Fund

will issue and redeem Shares only to Authorized Participants in exchange for

cash or a deposit or delivery of a basket of assets (securities and/or cash) in

large blocks, known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The

Fund intends to make distributions that may be taxed as ordinary

income or long-term capital gains. Those distributions will be subject to

federal income tax and may also be subject to state and local taxes, unless you

are investing through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account. Distributions or investments made through

tax-deferred arrangements may be taxed later upon withdrawal. Distributions by

the Fund may be significantly higher than those of most other ETFs.

Payments

to Broker-Dealers and Other Financial Intermediaries

If

you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank or financial advisor), the Fund and/or

its Adviser may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

Direxion

Shares ETF Trust Prospectus

36

Important

Information Regarding the Fund

The Direxion

Daily MSCI India Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the MSCI

India Index (the "Index"). The return for investors that invest for periods

longer or shorter than a trading day should not be expected to be 200% of the

performance of the Index for the period. The return of the Fund for a period

longer than a trading day will be the result of each trading day’s compounded

return over the period, which will very likely differ from 200% of the return of

the Index for that period. Longer holding periods, higher volatility of the

Index and leverage increase the impact of compounding on an investor’s returns.

During periods of higher Index volatility, the volatility of the Index may

affect the Fund’s return as much as, or more than, the return of the

Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

(1)

|

1 Year |

3

Years |

5

Years |

10

Years |

|

$ |

$ |

$ |

$ |

37

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

38

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

40

41

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

42

43

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

44

|

|

1 Year |

5

Years |

10

Years |

|

Return

Before Taxes |

40.57% |

6.63% |

-0.57% |

|

Return

After Taxes on

Distributions |

39.74% |

6.44% |

-0.66% |

|

Return

After Taxes on

Distributions

and Sale of

Fund

Shares |

24.53% |

5.20% |

-0.43% |

|

MSCI

India Index (reflects

no

deduction

for fees,

expenses

or taxes) |

26.23% |

15.08% |

10.85% |

|

S&P

500®

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

28.71% |

18.47% |

16.55% |

Management

Investment

Adviser. Rafferty Asset

Management, LLC

is

the Fund’s investment adviser.

Portfolio

Managers. The following

members of Rafferty’s investment team are jointly and primarily responsible for

the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of

Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception in

March

2010 |

Portfolio

Manager |

|

Tony

Ng |

Since

September

2015 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The

Fund’s individual shares may only be purchased or sold in the secondary

market through a broker-dealer or other

financial

intermediaries at market price rather than at net asset value. The

market price of Shares will fluctuate in response to changes in the value of the

Fund’s holdings and supply and demand for the Shares, which may result in

shareholders purchasing or selling the Shares on the secondary market at a

market price that is greater than net asset value (a premium) or less than net

asset value (a discount). A shareholder may incur costs attributable to the

difference between the highest price a buyer is willing to pay for the Fund’s

Shares (bid) and the lowest price a seller is willing to accept for the Fund’s

Shares (ask) when buying or selling Shares on the secondary market (the “bid-ask

spread”) in addition to brokerage commissions. The bid-ask spread may vary over

time for Shares based on trading volume and market liquidity. Recent information

regarding the Fund Shares such as net asset value, market price, premiums and

discounts and bid-ask spreads and related other information is available on the

Fund’s website, www.direxion.com/etfs?producttab=performance.

The

Fund’s shares are not individually redeemable by the Fund. The Fund

will issue and redeem Shares only to Authorized Participants in exchange for

cash or a deposit or delivery of a basket of assets (securities and/or cash) in

large blocks, known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The

Fund intends to make distributions that may be taxed as ordinary

income or long-term capital gains. Those distributions will be subject to

federal income tax and may also be subject to state and local taxes, unless you

are investing through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account. Distributions or investments made through

tax-deferred arrangements may be taxed later upon withdrawal. Distributions by

the Fund may be significantly higher than those of most other ETFs.

Payments

to Broker-Dealers and Other Financial Intermediaries

If

you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank or financial advisor), the Fund and/or

its Adviser may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

45

Direxion

Shares ETF Trust Prospectus

Important

Information Regarding the Fund

The Direxion

Daily Russia Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the MVIS

Russia Index (the "Index"). The return for investors that invest for periods

longer or shorter than a trading day should not be expected to be 200% of the

performance of the Index for the period. The return of the Fund for a period

longer than a trading day will be the result of each trading day’s compounded

return over the period, which will very likely differ from 200% of the return of

the Index for that period. Longer holding periods, higher volatility of the

Index and leverage increase the impact of compounding on an investor’s returns.

During periods of higher Index volatility, the volatility of the Index may

affect the Fund’s return as much as, or more than, the return of the

Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

(1)

|

1 Year |

3

Years |

5

Years |

10

Years |

|

$ |

$ |

$ |

$ |

Direxion

Shares ETF Trust Prospectus

46

47

Direxion

Shares ETF Trust Prospectus

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direxion

Shares ETF Trust Prospectus

48

49

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

50

51

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

52

53

Direxion

Shares ETF Trust Prospectus

|

|

1 Year |

5

Years |

10

Years |

|

Return

Before Taxes |

27.87% |

-10.49% |

-22.48% |

|

Return

After Taxes on

Distributions |

27.49% |

-10.75% |

-22.59% |

|

Return

After Taxes on

Distributions

and Sale of

Fund

Shares |

16.67% |

-7.49% |

-11.40% |

|

MVIS

Russia Index (reflects

no

deduction for fees,

expenses

or taxes) |

19.18% |

10.44% |

4.33% |

|

S&P

500®

Index (reflects

no

deduction

for fees,

expenses

or taxes) |

28.71% |

18.47% |

16.55% |

Direxion

Shares ETF Trust Prospectus

54

Management

Investment

Adviser. Rafferty Asset

Management, LLC

is

the Fund’s investment adviser.

Portfolio

Managers. The following

members of Rafferty’s investment team are jointly and primarily responsible for

the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of

Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception in

May

2011 |

Portfolio

Manager |

|

Tony

Ng |

Since

September

2015 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The

Fund’s individual shares may only be purchased or sold in the secondary

market through a broker-dealer or other financial intermediaries at market price

rather than at net asset value. The market price of Shares will fluctuate in

response to changes in the value of the Fund’s holdings and supply and demand

for the Shares, which may result in shareholders purchasing or selling the

Shares on the secondary market at a market price that is greater than net asset

value (a premium) or less than net asset value (a discount). A shareholder may

incur costs attributable to the

difference

between the highest price a buyer is willing to pay for the

Fund’s Shares (bid) and the lowest price a seller is willing to accept for the

Fund’s Shares (ask) when buying or selling Shares on the secondary market (the

“bid-ask spread”) in addition to brokerage commissions. The bid-ask spread may

vary over time for Shares based on trading volume and market liquidity. Recent

information regarding the Fund Shares such as net asset value, market price,

premiums and discounts and bid-ask spreads and related other information is

available on the Fund’s website,

www.direxion.com/etfs?producttab=performance.

The

Fund’s shares are not individually redeemable by the Fund. The Fund

will issue and redeem Shares only to Authorized Participants in exchange for

cash or a deposit or delivery of a basket of assets (securities and/or cash) in

large blocks, known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The

Fund intends to make distributions that may be taxed as ordinary

income or long-term capital gains. Those distributions will be subject to

federal income tax and may also be subject to state and local taxes, unless you

are investing through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account. Distributions or investments made through

tax-deferred arrangements may be taxed later upon withdrawal. Distributions by

the Fund may be significantly higher than those of most other ETFs.

Payments

to Broker-Dealers and Other Financial Intermediaries

If

you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank or financial advisor), the Fund and/or

its Adviser may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other financial intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial

intermediary’s website for more information.

55

Direxion

Shares ETF Trust Prospectus

Important

Information Regarding the Fund

The Direxion

Daily 5G Communications Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the

BlueStar® 5G Communications Index (the

"Index"). The return for investors that invest for periods longer or shorter

than a trading day should not be expected to be 200% of the performance of the

Index for the period. The return of the Fund for a period longer than a trading

day will be the result of each trading day’s compounded return over the period,

which will very likely differ from 200% of the return of the Index for that

period. Longer holding periods, higher volatility of the Index and leverage

increase the impact of compounding on an investor’s returns. During periods of

higher Index volatility, the volatility of the Index may affect the Fund’s

return as much as, or more than, the return of the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s

performance increases over a period longer than a single day. An investor could

lose the full principal value of his/her investment within a single day if the

Index loses more than 50% in one day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund |

|

|

Acquired

Fund Fees and Expenses |

|

|

Total

Annual Fund Operating Expenses |

|

|

Expense

Cap/Reimbursement(1)

|

- |

|

Total

Annual Fund Operating Expenses After

Expense

Cap/Reimbursement |

|

(1)

|

1 Year |

3

Years |

|

$ |

$ |

Direxion

Shares ETF Trust Prospectus

56

57

Direxion

Shares ETF Trust Prospectus

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direxion

Shares ETF Trust Prospectus

58

59

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

60

61

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

62

Management

Investment

Adviser. Rafferty

Asset Management, LLC

is the Fund’s

investment adviser.

Portfolio

Managers. The

following members of Rafferty’s investment team are jointly and primarily

responsible for the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since Inception in

June

2021 |

Portfolio

Manager |

|

Tony

Ng |

Since Inception in

June

2021 |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The Fund’s

individual shares may only be purchased or sold in the secondary market through a

broker-dealer or other financial intermediaries at market price rather than at

net asset value. The market price of Shares will fluctuate in response to

changes in the value of the Fund’s holdings and supply and demand for the

Shares, which may result

in shareholders

purchasing or selling the Shares on the secondary market at a market

price that is greater than net asset value (a premium) or less than net asset

value (a discount). A shareholder may incur costs attributable to the difference

between the highest price a buyer is willing to pay for the Fund’s Shares (bid)

and the lowest price a seller is willing to accept for the Fund’s Shares (ask)

when buying or selling Shares on the secondary market (the “bid-ask spread”) in

addition to brokerage commissions. The bid-ask spread may vary over time for

Shares based on trading volume and market liquidity. Recent information

regarding the Fund Shares such as net asset value, market price, premiums and

discounts and bid-ask spreads and related other information is available on the

Fund’s website, www.direxion.com/etfs?producttab=performance.

The Fund’s

shares are not individually redeemable by the Fund. The Fund will issue and

redeem Shares only to Authorized Participants in exchange for cash or a deposit

or delivery of a basket of assets (securities and/or cash) in large blocks,

known as creation units, each of which is comprised of 50,000

Shares.

Tax

Information

The Fund intends

to make distributions that may be taxed as ordinary income or long-term

capital gains. Those distributions will be subject to federal income tax and may

also be subject to state and local taxes, unless you are investing through a

tax-deferred arrangement, such as a 401(k) plan or an individual retirement

account. Distributions or investments made through tax-deferred arrangements may

be taxed later upon withdrawal. Distributions by the Fund may be significantly

higher than those of most other ETFs.

Payments to

Broker-Dealers and Other Financial Intermediaries

If you purchase

shares of the Fund through a broker-dealer or other financial intermediary

(such as a bank or financial advisor), the Fund and/or its Adviser may pay the

intermediary for the sale of Fund shares and related services. These payments

may create a conflict of interest by influencing the broker-dealer or other

financial intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your financial intermediary’s website

for more information.

63

Direxion

Shares ETF Trust Prospectus

Important

Information Regarding the Fund

The Direxion

Daily 5G Communications Bear 2X Shares (the “Fund”) seeks daily

inverse leveraged

investment results and is very different from most other exchange-traded funds.

As a result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily inverse performance of the

BlueStar® 5G Communications Index (the

"Index"). The return for investors that invest for periods longer or shorter

than a trading day should not be expected to be -200% of the performance of the

Index for the period. The return of the Fund for a period longer than a trading

day will be the result of each trading day’s compounded return over the period,

which will very likely differ from -200% of the return of the Index for that

period. Longer holding periods, higher volatility of the Index and leverage

increase the impact of compounding on an investor’s returns. During periods of

higher Index volatility, the volatility of the Index may affect the Fund’s

return as much as, or more than, the return of the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily inverse leveraged (-2X) investment results, understand the risks

associated with the use of leverage and shorting and are willing to monitor

their portfolios frequently. The Fund is not intended to be used by, and is not

appropriate for, investors who do not intend to actively monitor and manage

their portfolios. For periods longer than a single day, the Fund will lose money

if the Index’s performance is flat, and it is possible that the Fund will lose

money even if the Index’s performance decreases over a period longer than a

single day. An investor could lose the full principal value of his/her

investment within a single day if the Index gains more than 50% in one

day.

|

Management

Fees |

|

|

Distribution

and/or Service (12b-1) Fees |

|

|

Other

Expenses of the Fund(1)

|

|

|

Acquired

Fund Fees and Expenses(1)

|

|

|

Total

Annual Fund Operating Expenses |

|

|

Expense

Cap/Reimbursement(2)

|

- |

|

Total

Annual Fund Operating Expenses After

Expense

Cap/Reimbursement |

|

(1)

(2)

|

1 Year |

3

Years |

|

$ |

$ |

Direxion

Shares ETF Trust Prospectus

64

65

Direxion

Shares ETF Trust Prospectus

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direxion

Shares ETF Trust Prospectus

66

67

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

68

69

Direxion

Shares ETF Trust Prospectus

Direxion

Shares ETF Trust Prospectus

70

Management

Investment

Adviser. Rafferty

Asset Management, LLC

is the Fund’s

investment adviser.

Portfolio

Managers. The

following members of Rafferty’s investment team are jointly and primarily

responsible for the day-to-day management of the Fund:

|

Portfolio

Managers |

Years of Service

with the

Fund |

Primary

Title |

|

Paul

Brigandi |

Since

Inception |

Portfolio

Manager |

|

Tony

Ng |

Since

Inception |

Portfolio

Manager |

Purchase

and Sale of Fund Shares

The Fund’s

individual shares may only be purchased or sold in the secondary market through a

broker-dealer or other financial intermediaries at market price rather than at

net asset value. The market price of Shares will fluctuate in response to

changes in the value of the Fund’s holdings and supply and demand for the

Shares, which may result in shareholders purchasing or selling the Shares on the

secondary market at a market price that is greater than net asset value (a

premium) or less than net asset value (a discount). Additionally, a shareholder

may incur costs attributable to the difference between the highest price a buyer

is willing to pay for the Fund’s Shares (bid) and the lowest price a seller is

willing to accept for the Fund’s Shares (ask) when buying or selling Shares on

the secondary market (the “bid-ask spread”) in addition to brokerage

commissions. The bid-ask spread may vary over time for Shares based on trading

volume and market liquidity. Recent information regarding the Fund Shares such

as net asset value, market price, premiums and discounts, bid-ask spreads, and

related other information is available on the Fund’s website,

www.direxion.com/etfs?producttab=performance.

The Fund’s

shares are not individually redeemable by submitting Shares to the Fund.

The Fund will issue and redeem

71

Direxion

Shares ETF Trust Prospectus

Shares for cash

only to Authorized Participants in large blocks, known as creation units, each of

which is comprised of 50,000 Shares.

Tax

Information

The Fund intends

to make distributions that may be taxed as ordinary income or long-term

capital gains. Those distributions will be subject to federal income tax and may

also be subject to state and local taxes, unless you are investing through a

tax-deferred arrangement, such as a 401(k) plan or an individual retirement

account. Distributions or investments made through tax-deferred arrangements may

be taxed later upon withdrawal. Distributions by the Fund may be significantly

higher than those of most other ETFs.

Payments to

Broker-Dealers and Other Financial Intermediaries

If you purchase

shares of the Fund through a broker-dealer or other financial intermediary

(such as a bank or financial advisor), the Fund and/or its Adviser may pay the

intermediary for the sale of Fund shares and related services. These payments

may create a conflict of interest by influencing the broker-dealer or other

financial intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your financial intermediary’s website

for more information.

Direxion

Shares ETF Trust Prospectus

72

Important

Information Regarding the Fund

The Direxion

Daily Aviation Bull 2X Shares (the “Fund”) seeks daily

leveraged investment

results and is very different from most other exchange-traded funds. As a

result, the Fund may be riskier than alternatives that do not use leverage

because the Fund’s objective is to magnify the daily performance of the Indxx US

Pure Aviation Index (the "Index"). The return for investors that invest for

periods longer or shorter than a trading day should not be expected to be 200%

of the performance of the Index for the period. The return of the Fund for a

period longer than a trading day will be the result of each trading day’s

compounded return over the period, which will very likely differ from 200% of

the return of the Index for that period. Longer holding periods, higher

volatility of the Index and leverage increase the impact of compounding on an

investor’s returns. During periods of higher Index volatility, the volatility of

the Index may affect the Fund’s return as much as, or more than, the return of

the Index.

The

Fund is not suitable for all investors. The Fund is designed to be utilized

only by knowledgeable investors who understand the potential consequences of

seeking daily leveraged (2X) investment results, understand the risks associated

with the use of leverage and are willing to monitor their portfolios frequently.

The Fund is not intended to be used by, and is not appropriate for, investors

who do not intend to actively monitor and manage their portfolios. For periods

longer than a single day, the Fund will lose money if the Index’s performance is

flat, and it is possible that the Fund will lose money even if the Index’s