FUND

SERVICE

INSTITUTIONAL

| Prospectus | |||||||

| Investment, Service, and Institutional Class Shares | |||||||

|

FUND |

INVESTMENT |

SERVICE |

INSTITUTIONAL |

||||

| Royce Dividend Value Fund | — | ||||||

| Royce Global Financial Services Fund | — | RGFIX | |||||

| Royce International Premier Fund | RIPIX | ||||||

| Royce Micro-Cap Fund | — | ||||||

| Royce Premier Fund | RPFIX | ||||||

| Royce Small-Cap Fund | RPMIX | ||||||

| Royce Small-Cap Opportunity Fund | ROFIX | ||||||

| Royce Small-Cap Special Equity Fund | RSEIX | ||||||

| Royce Small-Cap Total Return Fund | RTRIX | ||||||

| Royce Small-Cap Value Fund | — | ||||||

| Royce Smaller-Companies Growth Fund | RVPIX | ||||||

| As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved of these securities, or determined that the information in this prospectus is accurate or complete. It is a crime to represent otherwise. | |||||||

| royceinvest.com |  |

||||||

| Table of Contents |  |

| Royce Dividend Value Fund | 2 |

| Royce Global Financial Services Fund | 5 |

| Royce International Premier Fund | 9 |

| Royce Micro-Cap Fund | 13 |

| Royce Premier Fund | 16 |

| (formerly Royce Pennsylvania Mutual Fund) | 20 |

| Royce Small-Cap Opportunity Fund | 24 |

| Royce Small-Cap Special Equity Fund | 27 |

| Royce Small-Cap Total Return Fund | 30 |

| Royce Small-Cap Value Fund | 34 |

| Royce Smaller-Companies Growth Fund | 37 |

| Financial Highlights | 41 |

| Royce’s Investment Universe | 46 |

| Investing in Foreign Securities | 50 |

| Management of the Funds | 52 |

| General Shareholder Information | 55 |

| Guide for Direct Shareholders | 60 |

| The Investment Class, Service Class, and Institutional Class, which is designed primarily for investment by or through foundations, endowments, retirement plans, similar institutions, and other eligible investors satisfying the minimum initial investment criteria for the Class, are offered without sales charges. |

The Royce Fund Prospectus 2024 | 1

Royce Dividend Value Fund’s investment goals are long-term growth of capital and current income.

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. Shares of the Fund purchased or held through a third party, such as a broker-dealer, bank, or other financial intermediary, may incur fees and expenses that are not reflected in the tables and examples below.

| INVESTMENT CLASS | SERVICE CLASS | |

| Maximum sales charge (load) imposed on purchases | ||

| Maximum deferred sales charge | ||

| Maximum sales charge (load) imposed on reinvested dividends | ||

| Management fees | ||

| Distribution and/or service (12b-1) fees | ||

| Other expenses | ||

| Total annual Fund operating expenses | ||

| Fee waivers and/or expense reimbursements | - |

- |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements | ||

|

The total annual Fund operating expense ratios are subject to change in response to changes in the Fund’s average net assets and/or for other reasons. A decline in the Fund’s average net assets can be expected to increase the impact of operating expenses on the Fund’s total annual operating expense ratios.

Royce

has contractually agreed, without right of termination, to waive fees

and/or reimburse expenses to the extent necessary to maintain the

Investment and Service Classes’ net annual operating expenses (excluding

brokerage commissions, taxes, interest, litigation expenses, acquired fund

fees and expenses, and other expenses not borne in the ordinary course of

business) at or below 1.09% and 1.34%, respectively, through

| ||

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the Investment and Service Classes in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be:

| ||

| INVESTMENT CLASS | SERVICE CLASS | |

| 1 Year | $ |

$ |

| 3 Years | $ |

$ |

| 5 Years | $ |

$ |

| 10 Years | $ |

$ |

The Fund

pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate

higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in total annual

Fund operating expenses or in the example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

2 | The Royce Fund Prospectus 2024

Royce Dividend Value Fund (continued)

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets primarily in dividend-paying equity securities of companies with stock market capitalizations up to $15 billion that it believes are trading below its estimate of their current worth. Royce bases this assessment chiefly on strong balance sheets and other indicators of financial strength. Royce also considers companies that it believes are well managed and/or have strong business prospects, as well as the potential for improvement in cash flow levels and internal rates of return.

As with any mutual fund that

invests in common stocks, Royce Dividend Value Fund is subject to market

risk—the possibility that common stock prices will decline over short and/or

extended periods of time due to overall market, financial, and economic

conditions, trends or events, governmental or central bank actions and/or

interventions, changes in investor sentiment, armed conflicts, economic

sanctions and countermeasures in response to sanctions, market disruptions

caused by trade disputes or other factors, political developments, major

cybersecurity events and acts of terrorism, the global and domestic effects of a

pandemic or epidemic, contagion effects on the finance sector and the overall

economy from banking industry instability, and other factors that may or may not

be directly related to the issuer of a security held by the Fund. Economies and

financial markets throughout the world are increasingly interconnected, and

economic, financial, or political events in one country or region could have

profound impacts on global economies or markets. Armed conflicts in Europe and

the Middle East, as well as any banking industry instability, may adversely

affect global economies, markets, industries, and individual companies in ways

that cannot necessarily be foreseen.

The prices of equity securities of companies with stock market capitalizations up to $15 billion are generally more volatile than those of larger-cap securities. In addition, because these securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes. There is no assurance that there will be net investment income to distribute and/or that the Fund will achieve its investment goals.

As of December 31, 2023, the Fund invested a significant portion of its assets in a limited number of issuers. Such a portfolio may involve considerably more risk to investors than one that invests in a larger number of issuers because such a portfolio may be more susceptible to any single corporate, economic, political, regulatory, or market event.

A significant portion of the Fund’s assets also may, from time to time, be invested in companies from a single sector or a limited number of sectors. Such an investment approach may involve considerably more risk to investors than one that is more broadly diversified across economic sectors because it may be more susceptible to corporate, economic, political, regulatory, or market events that adversely affect the relevant sector(s). As of December 31, 2023, the Fund invested a significant portion of its assets in companies from the Industrials and Financials sectors. Industrial companies can be significantly affected by commodity prices, import and export controls, worldwide competition, changes in consumer sentiment and spending, and liability for environmental damage, depletion of resources, and mandated expenditures for safety and pollution control. Financial companies can be significantly affected by interest rate changes, global investment trends, market conditions, and currency exchange rates. Companies in both sectors can be significantly affected by general economic trends, government regulation and spending, and legislation.

Investment in foreign securities involves risks that may not be encountered in U.S. investments, including adverse political, social, economic, environmental, public health, and/or other developments that are unique to a particular region or country. Prices of foreign securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

Royce’s estimate of a company’s current worth may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses or underperformance relative to similar funds and/or the Fund’s benchmark indexes. Additionally, selecting stocks based, in part, on a history of paying dividends may cause the Fund to underperform relative to funds that do not select stocks on this basis. Further, various factors may lead a company to unexpectedly reduce or eliminate dividend payments, which could adversely affect the market price of its securities. In addition, “value” stocks may remain undervalued for long periods (particularly during times of low or declining interest rates), undervaluation may become more severe, or perceived undervaluation may actually represent intrinsic value. Therefore, securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, Fund or investor data, or proprietary information. Such incidents may also cause the Fund, Royce, and/or their service providers to suffer data breaches, data corruption, or loss of operational functionality. In addition, cybersecurity incidents may prevent Fund

The Royce Fund Prospectus 2024 | 3

Royce Dividend Value Fund (concluded)

investors from purchasing, redeeming, or exchanging shares, as well as from receiving distributions. The Fund and Royce have limited ability to prevent or mitigate cybersecurity incidents affecting third-party service providers, and such third-party service providers may have limited indemnification obligations to the Fund or Royce. Cybersecurity incidents may result in significant financial losses to the Fund and its shareholders, and substantial costs may be incurred in order to prevent any future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers are affected by cybersecurity incidents.

Calendar Year Total Returns

Service Class (%)

During the period shown in the bar chart, the was % (quarter ended ) and the was % (quarter ended ).

The table also presents the

impact of taxes on the Fund’s returns (Service Class again used for illustrative

purposes). In calculating these figures,

As of 12/31/23 (%) | |||

| 1 YEAR | 5 YEAR | 10 YEAR | |

| Service Class | |||

| Return Before Taxes | |||

| Return After Taxes on Distributions | |||

|

Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Investment Class | |||

| Return Before Taxes | |||

| Russell 2500 Index | |||

| (Reflects no deductions for fees, expenses, or taxes) | |||

| Russell 2000 Index | |||

| (Reflects no deductions for fees, expenses, or taxes) | |||

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Charles M. Royce is the Fund’s portfolio manager. Mr. Royce has been portfolio manager since the Fund’s inception.

How to Purchase and Sell Fund Shares

Minimum initial investments for shares of the Fund’s Investment and Service Classes purchased directly from The Royce Fund:

| ACCOUNT TYPE | MINIMUM | ||

| Regular Account | $2,000 | ||

| IRA | $1,000 | ||

| Automatic Investment or Direct Deposit Plan Accounts | $1,000 | ||

| 401(k) Accounts | None |

The minimum for subsequent investments is $50, regardless of account type.

Investment and Service Class shares of the Fund purchased through a third party, such as a broker-dealer, bank, or other financial intermediary, may be subject to investment minimums that differ from those described in this Prospectus.

You may request to sell shares in your account at any time online, by telephone, and/or by mail. You may also purchase or sell Fund shares through a third party, such as a broker-dealer, bank, or other financial intermediary.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an IRA, a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a financial intermediary (such as a broker-dealer or bank), the Fund and its related companies may pay such intermediary for the sale of Fund shares, shareholder services, or other purposes. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4 | The Royce Fund Prospectus 2024

Royce Global Financial Services Fund’s investment goal is long-term growth of capital.

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. Shares of the Fund purchased or held through a third party, such as a broker-dealer, bank, or other financial intermediary, may incur fees and expenses that are not reflected in the tables and examples below.

| SERVICE CLASS | INSTITUTIONAL CLASS | |

| Maximum sales charge (load) imposed on purchases | ||

| Maximum deferred sales charge | ||

| Maximum sales charge (load) imposed on reinvested dividends |

| Management fees | ||

| Distribution and/or service (12b-1) fees | ||

| Other expenses | ||

| Acquired fund fees and expenses | ||

| Total annual Fund operating expenses | ||

| Fee waivers and/or expense reimbursements | - |

- |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

The total annual Fund operating expense ratios are subject to change in response to changes in the Fund’s average net assets and/or for other reasons. A decline in the Fund’s average net assets can be expected to increase the impact of operating expenses on the Fund’s total annual operating expense ratios.

Royce has

contractually agreed, without right of termination, to waive fees and/or

reimburse expenses to the extent necessary to maintain the Service and

Institutional Classes’ net annual operating expenses (excluding brokerage

commissions, taxes, interest, litigation expenses, acquired fund fees and

expenses, and other expenses not borne in the ordinary course of business) at or

below 1.49% through

Total annual Fund operating expenses may differ from the expense ratio in the Fund’s Financial Highlights because the highlights include only the Fund’s direct operating expenses and do not include acquired fund fees and expenses, which reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds and other investment companies.

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the Service and Institutional Classes in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be:

| ||

| SERVICE CLASS | INSTITUTIONAL CLASS | |

| 1 Year | $ |

$ |

| 3 Years | $ |

$ |

| 5 Years | $ |

$ |

| 10 Years | $ |

$ |

The Fund pays transaction

costs, such as commissions, when it buys and sells securities (or “turns over”

its portfolio). A higher portfolio turnover rate may indicate higher transaction

costs and may result in higher taxes when Fund shares are held in a taxable

account. These costs, which are not reflected in total annual Fund operating

expenses or in the example, affect the Fund’s performance. During the most

recent fiscal year, the Fund’s portfolio turnover rate was

The Royce Fund Prospectus 2024 | 5

Royce Global Financial Services Fund (continued)

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets primarily in equity securities of companies that are “principally” engaged in the financial services industry. Examples of such companies include: commercial and industrial banks, savings and loan associations, companies engaged in consumer and industrial finance, insurance, securities brokerage and investment management, real estate investment trusts, real estate management and development companies, other financial intermediaries, and firms that primarily serve the financial services industry. Royce seeks to invest in securities that are trading below its estimate of their current worth. Royce focuses on companies that it believes have strong balance sheets, other business strengths, and/or strong business prospects. Royce also considers companies with the potential for improvement in cash flow levels and internal rates of return. Although the Fund primarily focuses on securities of financial services companies with stock market capitalizations up to $10 billion, it may invest an equal or greater percentage of its assets in securities of companies with larger market capitalizations.

The Fund will invest at least 40% of its net assets in equity securities of companies headquartered in at least three different countries outside of the United States, under normal circumstances. During periods when market conditions are not deemed favorable by Royce, the Fund will invest at least 30% of its net assets in such companies. As a result, a substantial portion of the Fund’s assets may be invested in companies that are headquartered in a single country or in a limited number of countries. While the Fund anticipates that its investment in foreign securities will generally be in securities of companies that are headquartered in “developed countries,” the Fund may also invest up to 10% of its net assets in securities of companies that are headquartered in “developing countries.” Developing countries, sometimes also referred to as emerging markets countries, include every country in the world other than the United States, Canada, Japan, Australia, New Zealand, Hong Kong, Singapore, South Korea, Taiwan, Bermuda, Israel, and Western European countries (as defined in the Fund’s Statement of Additional Information). The Fund does not expect to purchase or sell foreign currencies to hedge against declines in the U.S. dollar or to lock in the value of any foreign securities that it purchases.

In selecting securities for the Fund, Royce uses a bottom-up, value approach. Royce primarily focuses on company-specific criteria rather than on political, economic, or other country-specific factors.

As with any mutual fund that

invests in common stocks, Royce Global Financial Services Fund is subject to

market risk—the possibility that common stock prices will decline over short

and/or extended periods of time due to overall market, financial, and economic

conditions, trends, or events, governmental or central bank actions or

interventions, changes in investor sentiment, armed conflicts, economic

sanctions and countermeasures in response to sanctions, market disruptions

caused by trade disputes or other factors, political developments, major

cybersecurity events and acts of terrorism, the global and domestic effects of a

pandemic or epidemic, contagion effects on the finance sector and the overall

economy from banking industry instability, and other factors that may or may not

be directly related to the issuer of a security held by the Fund. Economies and

financial markets throughout the world are increasingly interconnected, and

economic, financial, or political events in one country or region could have

profound impacts on global economies or markets. Armed conflicts in Europe and

the Middle East, as well as any recent banking industry instability, may

adversely affect global economies, markets, industries, and individual companies

in ways that cannot necessarily be foreseen.

The Fund focuses its investments in companies within the financial services industry. Such a portfolio may involve considerably more risk to investors than one that is more broadly diversified across economic sectors because such a portfolio may be more susceptible to corporate, economic, political, regulatory, or market events that adversely affect the financial services industry. Financial services companies are subject to extensive government regulation, can be significantly affected by changes in interest rates, the availability and cost of capital, the rate of corporate and consumer debt defaults, and price competition, and can be subject to relatively rapid change due to government interventions in capital, credit, and currency markets.

The prices of equity securities of companies with stock market capitalizations up to $10 billion are generally more volatile than those of larger-cap securities. In addition, because these securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from both non-financial services funds and funds investing in larger-cap companies or other asset classes.

As of December 31, 2023, the Fund invested a significant portion of its assets in a limited number of issuers. Such a portfolio may involve more risk to investors than one that invests in a larger number of issuers because such a portfolio may be more susceptible to any single corporate, economic, political, regulatory, or market event.

Investment in foreign securities involves risks that may not be encountered in U.S. investments, including adverse political, social, economic, environmental, public health, and/or other developments that are unique to a particular region or country. These risks may

6 | The Royce Fund Prospectus 2024

Royce Global Financial Services Fund (continued)

be heightened for developing markets securities. Prices of foreign securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. To the extent the Fund focuses its investments in issuers located in a particular country or region, the Fund is subject to greater risks of volatile economic cycles and/or conditions and developments that may be particular to that country or region. For example, the Fund may be subject to greater risk of adverse securities markets, exchange rates, social, political, regulatory, economic, business, environmental or other developments, or natural disasters. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

Royce’s estimate of a company’s current worth may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses or underperformance relative to similar funds and/or the Fund’s benchmark indexes. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

The Fund is not a complete investment program. Rather, it is designed for long-term investors who can accept the risks of investing in a fund with a limited number of common stock holdings primarily in financial services companies with market caps up to $5 billion.

Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, Fund or investor data, or proprietary information. Such incidents may also cause the Fund, Royce, and/or their service providers to suffer data breaches, data corruption, or loss of operational functionality. In addition, cybersecurity incidents may prevent Fund investors from purchasing, redeeming, or exchanging shares, as well as from receiving distributions. The Fund and Royce have limited ability to prevent or mitigate cybersecurity incidents affecting third-party service providers, and such third-party service providers may have limited indemnification obligations to the Fund or Royce. Cybersecurity incidents may result in significant financial losses to the Fund and its shareholders, and substantial costs may be incurred in order to prevent any future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers are affected by cybersecurity incidents.

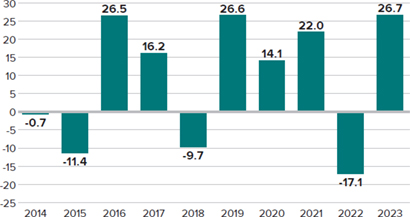

Calendar Year Total Returns

Service Class (%)

During the period shown in the bar chart, the was % (quarter ended ) and was % (quarter ended ).

The table

also presents the impact of taxes on the Fund’s returns (Service Class again

used for illustrative purposes). In calculating these figures,

Average Annual Total Returns

As of 12/31/23 (%)

| 1 YEAR | 5 YEAR | 10 YEAR | |

| Service Class | |||

| Return Before Taxes | |||

| Return After Taxes on Distributions | |||

| Return After Taxes on Distributions and Sale of | |||

| Fund Shares | |||

| Institutional Class | |||

| Return Before Taxes | |||

| MSCI ACWI Small Cap Index | |||

| (Reflects no deductions for fees, expenses, or taxes) | |||

| Russell 2000 Index | |||

| (Reflects no deductions for fees, expenses, or taxes) |

The Royce Fund Prospectus 2024 | 7

Royce Global Financial Services Fund (concluded)

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Charles M. Royce is the Fund’s portfolio manager. Mr. Royce has been the portfolio manager since the Fund’s inception.

How to Purchase and Sell Fund Shares

Minimum initial investments for shares of the Fund’s Service Class purchased directly from The Royce Fund:

| ACCOUNT TYPE | MINIMUM |

| Regular Account | $2,000 |

| IRA | $1,000 |

| Automatic Investment or Direct Deposit Plan Accounts | $1,000 |

| 401(k) Accounts | None |

The minimum for subsequent investments is $50, regardless of account type.

The minimum initial investment for Institutional Class shares is $1,000,000. Service Class shares of the Fund purchased through a third party, such as a broker-dealer, bank, or other financial intermediary, may be subject to investment minimums that differ from those described in this Prospectus.

You may request to sell shares in your account at any time online, by telephone, and/or by mail. You may also purchase or sell Fund shares through a third party, such as a broker-dealer, bank, or other financial intermediary.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an IRA, a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a financial intermediary (such as a broker-dealer or bank), the Fund and its related companies may pay such intermediary for the sale of Fund shares, shareholder services, or other purposes. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8 | The Royce Fund Prospectus 2024

Royce International Premier Fund’s investment goal is long-term growth of capital.

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. Shares of the Fund purchased or held through a third party, such as a broker-dealer, bank, or other financial intermediary, may incur fees and expenses that are not reflected in the tables and examples below.

| INVESTMENT CLASS | SERVICE CLASS | INSTITUTIONAL CLASS | |

| Maximum sales charge (load) imposed on purchases | |||

| Maximum deferred sales charge | |||

| Maximum sales charge (load) imposed on reinvested dividends | |||

| Management fees | |||

| Distribution and/or service (12b-1) fees | |||

| Other expenses | |||

| Total annual Fund operating expenses | |||

| Fee waivers and/or expense reimbursements | - |

- |

- |

| Total annual Fund operating expenses after fee waivers and/or | |||

| expense reimbursements |

The total annual Fund operating expense ratios are subject to change in response to changes in the Fund’s average net assets and/or for other reasons. A decline in the Fund’s average net assets can be expected to increase the impact of operating expenses on the Fund’s total annual operating expense ratios.

Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment, Service, and Institutional Classes’ net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.19%, 1.44% and 1.04%, respectively, through April 30, 2025.

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the Investment, Service, and Institutional Classes in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be: | |||

| INVESTMENT CLASS | SERVICE CLASS | INSTITUTIONAL CLASS | |

| 1 Year | $ |

$ |

$ |

| 3 Years | $ |

$ |

$ |

| 5 Years | $ |

$ |

$ |

| 10 Years | $ |

$ |

$ |

The Fund

pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate

higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in total annual

Fund operating expenses or in the example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

The Royce Fund Prospectus 2024 | 9

Royce International Premier Fund (continued)

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets in a limited number (generally less than 100) of equity securities of small-cap companies issued by non-U.S. (“international”) companies headquartered outside of the United States. Royce looks for companies trading below its estimate of their current worth that it considers “premier”—those that have strong balance sheets, other business strengths, and/or strong business prospects. In addition, Royce considers companies with the potential for improvement in cash flow levels and internal rates of return.

The Fund invests at least 80% of its net assets in equity securities of such premier companies headquartered outside of the United States, under normal circumstances. At least 65% of these securities will be issued by small-cap companies, that is, those with stock market capitalizations up to $5 billion at the time of investment. Under normal market circumstances, at least 65% of the Fund’s net assets will be invested in equity securities of international companies headquartered in at least three different countries. From time to time, a substantial portion of the Fund’s assets may be invested in companies that are headquartered in a single country. Although the Fund may invest without limit in the equity securities of companies headquartered outside of the United States, no more than 35% of the Fund’s net assets may be invested in securities of companies headquartered in “developing countries.” Developing countries, sometimes also referred to as emerging market countries, include every country in the world other than the United States, Canada, Japan, Australia, New Zealand, Hong Kong, Singapore, South Korea, Taiwan, Bermuda, Israel, and Western European countries (as defined in the Fund’s Statement of Additional Information). The Fund does not expect to purchase or sell foreign currencies to hedge against declines in the U.S. dollar or to lock in the value of any foreign securities that it purchases.

As with any

mutual fund that invests in common stocks, Royce International Premier Fund is

subject to market risk—the possibility that common stock prices will decline

over short and/or extended periods of time due to overall market, financial, and

economic conditions, trends, or events, governmental or central bank actions or

interventions, changes in investor sentiment, armed conflicts, economic

sanctions and countermeasures in response to sanctions, market disruptions

caused by trade disputes or other factors, political developments, major

cybersecurity events and acts of terrorism, the global and domestic effects of a

pandemic or epidemic, contagion effects on the finance sector and the overall

economy from banking industry instability, and other factors that may or may not

be directly related to the issuer of a security held by the Fund. Economies and

financial markets throughout the world are increasingly interconnected, and

economic, financial, or political events in one country or region could have

profound impacts on global economies or markets. Armed conflicts in Europe and

the Middle East, as well as any banking industry instability, may adversely

affect global economies, markets, industries, and individual companies in ways

that cannot necessarily be foreseen.

In addition to general market risk, securities of international companies may be subject to different risks than investments in U.S. securities, including adverse political, social, economic, environmental, public health, and/or other developments that are unique to a particular country or region. Prices of international securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. To the extent the Fund focuses its investments in issuers located in a particular country or region, the Fund is subject to greater risks of volatile economic cycles and/or conditions and developments that may be particular to that country or region. For example, the Fund may be subject to greater risk of adverse securities markets, exchange rates, social, political, regulatory, economic, business, environmental or other developments, or natural disasters. The Fund’s investments are usually denominated in or tied to the currencies of the countries in which they are primarily traded. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar. This may occur even if the value of the investment in the currency’s home country has not declined. These risk factors may affect the prices of international securities issued by companies headquartered in developing countries more than those headquartered in developed countries. For example, many developing countries have in the past experienced high rates of inflation or sharply devalued their currencies against the U.S. dollar, thereby causing the value of investments in companies located in those countries to decline. Transaction costs are often higher in developing countries, and there may be delays in settlement procedures. To the extent that the Fund’s investments in the securities of international companies consist of non-U.S. headquartered companies that trade on a U.S. exchange, some or all of the above-stated risks of investing in international companies may not apply.

The prices of small-cap securities are generally more volatile than those of larger-cap securities. In addition, because small-cap securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes.

The Fund’s investment in a limited number of issuers may involve considerably more risk to investors than funds that invest in a larger number of issuers because it may be more susceptible to any single corporate, economic, political, regulatory, or market event. A significant

10 | The Royce Fund Prospectus 2024

Royce International Premier Fund (continued)

portion of the Fund’s assets also may, from time to time, be invested in companies from a single sector or a limited number of sectors. Such an investment approach may involve considerably more risk to investors than one that is more broadly diversified across economic sectors because it may be more susceptible to corporate, economic, political, regulatory, or market events that adversely affect the relevant sector(s). As of December 31, 2023, the Fund invested a significant portion of its assets in companies from the Industrials and Information Technology sectors. Industrials sector companies can be significantly affected by general economic trends, commodity prices, legislation, government regulation and spending, import and export controls, worldwide competition, changes in consumer sentiment and spending, and liability for environmental damage, depletion of resources, and mandated expenditures for safety and pollution control. In addition, companies from the Information Technology sector can be significantly affected by the obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions.

Royce’s estimate of a company’s current worth may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses or underperformance relative to similar funds and/or the Fund’s benchmark index. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, Fund or investor data, or proprietary information. Such incidents may also cause the Fund, Royce, and/or their service providers to suffer data breaches, data corruption, or loss of operational functionality. In addition, cybersecurity incidents may prevent Fund investors from purchasing, redeeming, or exchanging shares, as well as from receiving distributions. The Fund and Royce have limited ability to prevent or mitigate cybersecurity incidents affecting third-party service providers, and such third-party service providers may have limited indemnification obligations to the Fund or Royce. Cybersecurity incidents may result in significant financial losses to the Fund and its shareholders, and substantial costs may be incurred in order to prevent any future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers are affected by cybersecurity incidents.

Calendar Year Total Returns

Service Class (%)

During the period shown in the bar chart, the was % (quarter ended ) and the was % (quarter ended ).

The table

also presents the impact of taxes on the Fund’s returns (Service Class again

used for illustrative purposes). In calculating these figures,

As of 12/31/23 (%)

| 1 YEAR | 5 YEAR | 10 YEAR | |

| Service Class | |||

| Return Before Taxes | |||

| Return After Taxes on Distributions | |||

| Return After Taxes on Distributions and Sale of Fund Shares | |||

| Investment Class | |||

| Return Before Taxes | |||

| Institutional Class | |||

| Return Before Taxes | |||

| MSCI ACWI ex USA Small Cap Index | |||

| (Reflects no deductions for fees, expenses, or taxes) |

The Royce Fund Prospectus 2024 | 11

Royce International Premier Fund (concluded)

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Mark Fischer is the Fund’s portfolio manager. He is assisted by Portfolio Manager Mark Rayner. Mr. Fischer became portfolio manager on January 1, 2023. He was previously co-portfolio manager (May 1, 2022–December 31, 2022) and portfolio manager (May 1, 2021–April 30, 2022). Mr. Rayner became assistant portfolio manager on January 1, 2023. He was previously co-portfolio manager (May 1, 2022– December 31, 2022), lead portfolio manager (May 1, 2021–April 30, 2022), portfolio manager (2016–2021), and assistant portfolio manager (2014–2015).

How to Purchase and Sell Fund Shares

Minimum initial investments for shares of the Fund’s Investment and Service Classes purchased directly from The Royce Fund:

| ACCOUNT TYPE | MINIMUM |

| Regular Account | $2,000 |

| IRA | $1,000 |

| Automatic Investment or Direct Deposit Plan Accounts | $1,000 |

| 401(k) Accounts | None |

The minimum for subsequent investments is $50, regardless of account type.

The minimum initial investment for Institutional Class shares is $1,000,000. Investment and Service Class shares of the Fund purchased through a third party, such as a broker-dealer, bank, or other financial intermediary, may be subject to investment minimums that differ from those described in this Prospectus.

You may request to sell shares in your account at any time online, by telephone, and/or mail. You may also purchase or sell Fund shares through a third party, such as a broker-dealer, bank, or other financial intermediary.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an IRA, a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a financial intermediary (such as a broker-dealer or bank), the Fund and its related companies may pay such intermediary for the sale of Fund shares, shareholder services, or other purposes. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12 | The Royce Fund Prospectus 2024

Royce Micro-Cap Fund’s investment goal is long-term growth of capital.

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. Shares of the Fund purchased or held through a third party, such as a broker-dealer, bank, or other financial intermediary, may incur fees and expenses that are not reflected in the tables and examples below.

| INVESTMENT CLASS | SERVICE CLASS | |

| Maximum sales charge (load) imposed on purchases | ||

| Maximum deferred sales charge | ||

| Maximum sales charge (load) imposed on reinvested dividends | ||

| Management fees | ||

| Distribution and/or service (12b-1) fees | ||

| Other expenses | ||

| Total annual Fund operating expenses | ||

| Fee waivers and/or expense reimbursements | - |

- |

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

The total annual Fund operating expense ratios are subject to change in response to changes in the Fund’s average net assets and/or for other reasons. A decline in the Fund’s average net assets can be expected to increase the impact of operating expenses on the Fund’s total annual operating expense ratios.

Royce has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment and Service Classes’ net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.24% and 1.49%, respectively, through April 30, 2025.

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the Investment and Service Classes in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be:

| ||

| INVESTMENT CLASS | SERVICE CLASS | |

| 1 Year | $ |

$ |

| 3 Years | $ |

$ |

| 5 Years | $ |

$ |

| 10 Years | $ |

$ |

The Fund

pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate

higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in total annual

Fund operating expenses or in the example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

The Royce Fund Prospectus 2024 | 13

Royce Micro-Cap Fund (continued)

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets primarily in equity securities of micro-cap companies. Micro-cap companies are those that have a market capitalization not greater than that of the largest company in the Russell Microcap® Index at the time of its most recent reconstitution. Royce uses multiple investment themes and offers wide exposure to micro-cap stocks by investing in companies with strong fundamentals and/or prospects selling at prices that Royce believes do not fully reflect these attributes. Royce considers companies with strong balance sheets, attractive growth prospects, and/or the potential for improvement in cash flow levels and internal rates of return, among other factors.

As with any

mutual fund that invests in common stocks, Royce Micro-Cap Fund is subject to

market risk—the possibility that common stock prices will decline over short

and/or extended periods of time due to overall market, financial, and economic

conditions, trends or events, governmental or central bank actions and/or

interventions, changes in investor sentiment, armed conflicts, economic

sanctions and countermeasures in response to sanctions, market disruptions

caused by trade disputes or other factors, political developments, major

cybersecurity events and acts of terrorism, the global and domestic effects of a

pandemic or epidemic, contagion effects on the finance sector and the overall

economy from banking industry instability, and other factors that may or may not

be directly related to the issuer of a security held by the Fund. Economies and

financial markets throughout the world are increasingly interconnected, and

economic, financial, or political events in one country or region could have

profound impacts on global economies or markets. Armed conflicts in Europe and

the Middle East, as well as any recent banking industry instability, may

adversely affect global economies, markets, industries, and individual companies

in ways that cannot necessarily be foreseen.

The prices of micro-cap securities are generally more volatile than those of larger-cap securities. In addition, because micro-cap securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes.

A significant portion of the Fund’s assets may, from time to time, be invested in companies from a single sector or a limited number of sectors. Such an investment approach may involve considerably more risk to investors than one that is more broadly diversified across economic sectors because it may be more susceptible to corporate, economic, political, regulatory, or market events that adversely affect the relevant sector(s). As of December 31, 2023, the Fund invested a significant portion of its assets in companies from the Information Technology and Industrials sectors. Information Technology sector companies can be significantly affected by the obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. In addition, companies from the Industrials sector can be significantly affected by general economic trends, commodity prices, legislation, government regulation and spending, import and export controls, worldwide competition, changes in consumer sentiment and spending, and liability for environmental damage, depletion of resources, and mandated expenditures for safety and pollution control.

Investment in foreign securities involves risks that may not be encountered in U.S. investments, including adverse political, social, economic, environmental, public health, and/or other developments that are unique to a particular region or country. Prices of foreign securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

Royce’s estimate of a company’s current worth may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses or underperformance relative to similar funds and/or the Fund’s benchmark indexes. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, Fund or investor data, or proprietary information. Such incidents may also cause the Fund, Royce, and/or their service providers to suffer data breaches, data corruption, or loss of operational functionality. In addition, cybersecurity incidents may prevent Fund investors from purchasing, redeeming, or exchanging shares, as well as from receiving distributions. The Fund and Royce have limited ability to prevent or mitigate cybersecurity incidents affecting third-party service providers, and such third-party service providers may have limited indemnification obligations to the Fund or Royce. Cybersecurity incidents may result in significant financial losses to the Fund and its shareholders, and substantial costs may be incurred in order to prevent any future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers are affected by cybersecurity incidents.

14 | The Royce Fund Prospectus 2024

Royce Micro-Cap Fund (concluded)

Calendar Year Total Returns

Investment Class (%)

During the period shown in the bar chart, the was % (quarter ended ) and the was % (quarter ended ).

The table

also presents the impact of taxes on the Fund’s returns (Investment Class again

used for illustrative purposes; after-tax returns differ by Class and would have

been lower for the Service Class). In calculating these figures,

As of 12/31/23 (%)

| 1 YEAR | 5 YEAR | 10 YEAR | |

| Investment Class | |||

| Return Before Taxes | |||

| Return After Taxes on Distributions | |||

| Return After Taxes on Distributions and Sale of Fund Shares | |||

| Service Class | |||

| Return Before Taxes | |||

| Russell Microcap Index | |||

| (Reflects no deductions for fees, expenses, or taxes) | |||

| Russell 2000 Index | |||

| (Reflects no deductions for fees, expenses, or taxes) |

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. James P. Stoeffel is the Fund’s lead portfolio manager, and Portfolio Manager Brendan J. Hartman manages the Fund with him. Mr. Stoeffel previously co-managed the Fund (2015). Mr. Hartman was previously assistant portfolio manager (2013-2015).

How to Purchase and Sell Fund Shares

Minimum initial investments for shares of the Fund’s Investment and Service Classes purchased directly from The Royce Fund:

| ACCOUNT TYPE | MINIMUM |

| Regular Account | $2,000 |

| IRA | $1,000 |

| Automatic Investment or Direct Deposit Plan Accounts | $1,000 |

| 401(k) Accounts | None |

The minimum for subsequent investments is $50, regardless of account type.

Investment and Service Class shares of the Fund purchased through a third party, such as a broker-dealer, bank, or other financial intermediary, may be subject to investment minimums that differ from those described in this Prospectus.

You may request to sell shares in your account at any time online, by telephone, and/or by mail. You may also purchase or sell Fund shares through a third party, such as a broker-dealer, bank, or other financial intermediary.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an IRA, a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a financial intermediary (such as a broker-dealer or bank), the Fund and its related companies may pay such intermediary for the sale of Fund shares, shareholder services, or other purposes. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

The Royce Fund Prospectus 2024 | 15

Royce Premier Fund’s investment goal is long-term growth of capital.

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. Shares of the Fund purchased or held through a third party, such as a broker-dealer, bank, or other financial intermediary, may incur fees and expenses that are not reflected in the tables and examples below.

| INVESTMENT CLASS | SERVICE CLASS | INSTITUTIONAL CLASS | |

| Maximum sales charge (load) imposed on purchases | |||

| Maximum deferred sales charge | |||

| Maximum sales charge (load) imposed on reinvested dividends |

| Management fees | ||||||

| Distribution and/or service (12b-1) fees | ||||||

| Other expenses | ||||||

| Total annual Fund operating expenses | ||||||

| Fee waivers and/or expense reimbursements | - |

|||||

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

The total annual Fund operating expense ratios are subject to change in response to changes in the Fund’s average net assets and/or for other reasons. A decline in the Fund’s average net assets can be expected to increase the impact of operating expenses on the Fund’s total annual operating expense ratios.

Royce has

contractually agreed, without right of termination, to waive fees and/or

reimburse expenses to the extent necessary to maintain the Service Class’s net

annual operating expenses (excluding brokerage commissions, taxes, interest,

litigation expenses, acquired fund fees and expenses, and other expenses not

borne in the ordinary course of business) at or below 1.49% through

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s total operating expenses (net of fee waivers and/or expense reimbursements for the Service Class in year one) remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be:

|

| INVESTMENT CLASS | SERVICE CLASS | INSTITUTIONAL CLASS | ||||

| 1 Year | $ |

$ |

$ |

|||

| 3 Years | $ |

$ |

$ |

|||

| 5 Years | $ |

$ |

$ |

|||

| 10 Years | $ |

$ |

$ |

|||

The Fund

pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate

higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in total annual

Fund operating expenses or in the example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

16 | The Royce Fund Prospectus 2024

Royce Premier Fund (continued)

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets in a limited number (generally less than 100) of equity securities of primarily small-cap companies at the time of investment. Small-cap companies are those that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution. Royce looks for companies that it considers “premier”—those that it believes are trading below its estimate of their current worth that also have excellent business strengths, strong balance sheets and/or improved prospects for growth, the potential for improvement in cash flow levels and internal rates of return, and franchise durability.

As with any

mutual fund that invests in common stocks, Royce Premier Fund is subject to

market risk—the possibility that common stock prices will decline over short

and/or extended periods of time due to overall market, financial, and economic

conditions, trends, or events, governmental or central bank actions or

interventions, changes in investor sentiment, armed conflicts, economic

sanctions and countermeasures in response to sanctions, market disruptions

caused by trade disputes or other factors, political developments, major

cybersecurity events and acts of terrorism, the global and domestic effects of a

pandemic or epidemic, contagion effects on the finance sector and the overall

economy from banking industry instability, and other factors that may or may not

be directly related to the issuer of a security held by the Fund. Economies and

financial markets throughout the world are increasingly interconnected, and

economic, financial, or political events in one country or region could have

profound impacts on global economies or markets. Armed conflicts in Europe and

the Middle East, as well as any recent banking industry instability, may

adversely affect global economies, markets, industries, and individual companies

in ways that cannot necessarily be foreseen.

The prices of small-cap securities are generally more volatile than those of larger-cap securities. In addition, because small-cap securities tend to have significantly lower trading volumes than larger-cap securities, the Fund may have difficulty selling holdings or may only be able to sell holdings at prices substantially lower than what Royce believes they are worth. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in larger-cap companies or other asset classes.

The Fund’s investment in a limited number of issuers may involve considerably more risk to investors than funds that invest in a larger number of issuers because it may be more susceptible to any single corporate, economic, political, regulatory, or market event. A significant portion of the Fund’s assets also may, from time to time, be invested in companies from a single sector or a limited number of sectors. Such an investment approach may involve considerably more risk to investors than one that is more broadly diversified across economic sectors because it may be more susceptible to corporate, economic, political, regulatory, or market events that adversely affect the relevant sector(s). As of December 31, 2023, the Fund invested a significant portion of its assets in companies from the Industrials sector. These companies can be significantly affected by general economic trends, commodity prices, legislation, government regulation and spending, import and export controls, worldwide competition, changes in consumer sentiment and spending, and liability for environmental damage, depletion of resources, and mandated expenditures for safety and pollution control.

Investment in foreign securities involves risks that may not be encountered in U.S. investments, including adverse political, social, economic, environmental, public health, and/or other developments that are unique to a particular region or country. Prices of foreign securities in particular countries or regions may, at times, move in a different direction and/or be more volatile than those of U.S. securities. Because the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of the Fund’s investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

Royce’s estimate of a company’s current worth may prove to be inaccurate, or this estimate may not be recognized by other investors, which could lead to portfolio losses or underperformance relative to similar funds and/or the Fund’s benchmark index. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some securities may continue to be undervalued for long periods of time or may never reach what Royce believes are their full market values.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. This Prospectus is not a contract.

Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, Fund or investor data, or proprietary information. Such incidents may also cause the Fund, Royce, and/or their service providers to suffer data breaches, data corruption, or loss of operational functionality. In addition, cybersecurity incidents may prevent Fund investors from purchasing, redeeming, or exchanging shares, as well

The Royce Fund Prospectus 2024 | 17

Royce Premier Fund (continued)

as from receiving distributions. The Fund and Royce have limited ability to prevent or mitigate cybersecurity incidents affecting third-party service providers, and such third-party service providers may have limited indemnification obligations to the Fund or Royce. Cybersecurity incidents may result in significant financial losses to the Fund and its shareholders, and substantial costs may be incurred in order to prevent any future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers are affected by cybersecurity incidents.

Calendar Year Total Returns

Investment Class (%)

During the period shown in the bar chart, the was % (quarter ended ) and the was % (quarter ended ).

The table

also presents the impact of taxes on the Fund’s returns (Investment Class again

used for illustrative purposes; after-tax returns differ by Class and would have

been lower for the Service Class). In calculating these figures,

As of 12/31/23 (%)

| 1 YEAR | 5 YEAR | 10 YEAR | |

| Investment Class | |||

| Return Before Taxes | |||

| Return After Taxes on Distributions | |||

| Return After Taxes on Distributions and Sale of Fund Shares | |||

| Service Class | |||

| Return Before Taxes | |||

| Institutional Class | |||

| Return Before Taxes | |||

| Russell 2000 Index | |||

| (Reflects no deductions for fees, expenses, or taxes) |

Investment Adviser and Portfolio Management

Royce & Associates, LP is the Fund’s investment adviser and a limited partnership organized under the laws of Delaware. Royce & Associates primarily conducts its business under the name Royce Investment Partners. Portfolio Managers Lauren A. Romeo and Steven G. McBoyle are the Fund’s co-lead portfolio managers. Portfolio Manager Charles M. Royce manages the Fund with them. They are assisted by Portfolio Manager Andrew S. Palen. Ms. Romeo and Mr. McBoyle became co-lead portfolio managers on April 1, 2022. Ms. Romeo (2016-2022) and Mr. McBoyle (2016-2022) were previously the Fund’s portfolio managers. Prior to that, Ms. Romeo (2006-2015) and Mr. McBoyle (2014-2015) were the Fund’s assistant portfolio managers. Mr. Royce has been portfolio manager since the Fund’s inception. Mr. Palen became assistant portfolio manager on February 7, 2022.

18 | The Royce Fund Prospectus 2024

Royce Premier Fund (concluded)

How to Purchase and Sell Fund Shares

Minimum initial investments for shares of the Fund’s Investment and Service Classes purchased directly from The Royce Fund:

| ACCOUNT TYPE | MINIMUM |

| Regular Account | $2,000 |

| IRA | $1,000 |

| Automatic Investment or Direct Deposit Plan Accounts | $1,000 |

| 401(k) Accounts | None |

The minimum for subsequent investments is $50, regardless of account type.

The minimum initial investment for Institutional Class shares is $1,000,000. Investment and Service Class shares of the Fund purchased through a third party, such as a broker-dealer, bank, or other financial intermediary, may be subject to investment minimums that differ from those described in this Prospectus.

You may request to sell shares in your account at any time online, by telephone, and/or by mail. You may also purchase or sell Fund shares through a third party, such as a broker-dealer, bank, or other financial intermediary.

Tax Information

The Fund intends to make distributions that are expected to be taxable to you as ordinary income or capital gains unless you are tax exempt or your investment is in an IRA, a 401(k) plan, or is otherwise tax deferred.

Financial Intermediary Compensation

If you purchase the Fund through a financial intermediary (such as a broker-dealer or bank), the Fund and its related companies may pay such intermediary for the sale of Fund shares, shareholder services, or other purposes. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

The Royce Fund Prospectus 2024 | 19

Royce Small-Cap Fund

(formerly Royce Pennsylvania Mutual Fund)

Royce Small-Cap Fund’s investment goal is long-term growth of capital.

The following table presents the fees and expenses that you may pay if you buy and hold shares of the Fund. Shares of the Fund purchased or held through a third party, such as a broker-dealer, bank, or other financial intermediary, may incur fees and expenses that are not reflected in the tables and examples below.

| INVESTMENT CLASS | SERVICE CLASS | INSTITUTIONAL CLASS | |

| Maximum sales charge (load) imposed on purchases | |||

| Maximum deferred sales charge | |||

| Maximum sales charge (load) imposed on reinvested dividends | |||

| Annual Trustee’s Fee—applies only to GiftShare Accounts* | $ |

$ |

N/A |

| Management fees | |||

| Distribution and/or service (12b-1) fees | |||

| Other expenses | |||

| Total annual Fund operating expenses |

The total annual Fund operating expense ratios are subject to change in response to changes in the Fund’s average net assets and/or for other reasons. A decline in the Fund’s average net assets can be expected to increase the impact of operating expenses on the Fund’s total annual operating expense ratios.

*Each GiftShare account pays an annual trustee fee of $50 to Alliance Trust Company, as trustee. Such fee is not included in the total annual Fund operating expenses shown above. If such fee was included, total annual Fund operating expenses would be higher.

|

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s total operating expenses remain the same. Although your actual costs may be higher or lower, based on the assumptions your costs would be: |

| INVESTMENT CLASS | SERVICE CLASS | INSTITUTIONAL CLASS | |

| 1 Year | $ |

$ |

$ |

| 3 Years | $ |

$ |

$ |

| 5 Years | $ |

$ |

$ |

| 10 Years | $ |

$ |

$ |

The Fund

pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate

higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in total annual

Fund operating expenses or in the example, affect the Fund’s performance. During

the most recent fiscal year, the Fund’s portfolio turnover rate was

20 | The Royce Fund Prospectus 2024

Royce Small-Cap Fund (formerly Royce Pennsylvania Mutual Fund) (continued)

Royce Investment Partners (“Royce”), the Fund’s investment adviser, invests the Fund’s assets primarily in equity securities of small-cap companies that it believes are trading below its estimate of their current worth. Small-cap companies are those that have a market capitalization not greater than that of the largest company in the Russell 2000® Index at the time of its most recent reconstitution.

The Fund uses multiple investment disciplines in an effort to provide exposure to approaches that have historically performed well in different market environments. These disciplines include “High Quality,” which looks for companies that have high returns on invested capital and that Royce believes have significant competitive advantages; “Emerging Quality,” which seeks companies that are newer in their lifecycle but that Royce believes can become High Quality in the future; “Traditional Value,” which looks for companies trading at prices below Royce’s estimate of their current worth; and “Quality Value,” which seeks companies with attractive profit margins, strong free cash flows, and lower leverage that also trade at what Royce believes are attractive valuations. The Fund’s portfolio managers generally focus on one of these approaches in managing segments of the Fund’s assets, while the Lead Portfolio Manager collaborates with the managers across all segments.

Primary Risks for Fund Investors

As with any

mutual fund that invests in common stocks, Royce Small-Cap Fund is subject to

market risk—the possibility that common stock prices will decline over short

and/or extended periods of time due to overall market, financial, and economic

conditions, trends, or events, governmental or central bank actions or

interventions, changes in investor sentiment, armed conflicts, economic

sanctions and countermeasures in response to sanctions, market disruptions

caused by trade disputes or other factors, political developments, major

cybersecurity events and acts of terrorism, the global and domestic effects of a

pandemic or epidemic, contagion effects on the finance sector and the overall

economy from banking industry instability, and other factors that may or may not

be directly related to the issuer of a security held by the Fund. Economies and

financial markets throughout the world are increasingly interconnected, and

economic, financial, or political events in one country or region could have

profound impacts on global economies or markets. Armed conflicts in Europe and

the Middle East, as well as any recent banking industry instability, may

adversely affect global economies, markets, industries, and individual companies

in ways that cannot necessarily be foreseen.