Goldman Sachs Funds Semi-Annual Report February 29, 2024 Goldman Sachs ActiveBeta® ETFs ActiveBeta® Emerging Markets Equity ETF (GEM) ActiveBeta® Europe Equity ETF (GSEU) ActiveBeta® International Equity ETF (GSIE) ActiveBeta® Japan Equity ETF (GSJY) ActiveBeta® U.S. Large Cap Equity ETF (GSLC) ActiveBeta® U.S. Small Cap Equity ETF (GSSC) ActiveBeta® World Low Vol Plus Equity ETF (GLOV) ActiveBeta® is a registered trademark of GSAM.

Goldman Sachs ActiveBeta® Equity ETFs

| ∎ |

ACTIVEBETA® EMERGING MARKETS EQUITY ETF (GEM) | |

| ∎ |

ACTIVEBETA® EUROPE EQUITY ETF (GSEU) | |

| ∎ |

ACTIVEBETA® INTERNATIONAL EQUITY ETF (GSIE) | |

| ∎ |

ACTIVEBETA® JAPAN EQUITY ETF (GSJY) | |

| ∎ |

ACTIVEBETA® U.S. LARGE CAP EQUITY ETF (GSLC) | |

| ∎ |

ACTIVEBETA® U.S. SMALL CAP EQUITY ETF (GSSC) | |

| ∎ |

ACTIVEBETA® WORLD LOW VOL PLUS EQUITY ETF (GLOV) |

| 1 | ||||

| 6 | ||||

| 28 | ||||

| 94 | ||||

| 102 | ||||

| 102 | ||||

| 103 | ||||

| 104 | ||||

| 105 | ||||

| 106 | ||||

| 107 | ||||

| 108 | ||||

| 109 | ||||

| 137 | ||||

Effective January 24, 2023, open-end mutual funds and exchange traded funds will be required to provide shareholders with streamlined annual and semi-annual shareholder reports (“Tailored Shareholder Reports”). Funds will be required to prepare a separate Tailored Shareholder Report for each share class of a fund that highlights key information to investors. Other information, including financial statements, will no longer appear in a fund’s shareholder report, but will be available online, delivered free of charge upon request, and filed with the Securities and Exchange Commission on a semi-annual basis on Form N-CSR. The new requirements have a compliance date of July 24, 2024.

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||||

MARKET REVIEW

Goldman Sachs ActiveBeta® Equity ETFs

February 29, 2024

The following are highlights both of key factors affecting U.S., international and emerging markets equity markets and of any key changes made to the Goldman Sachs ActiveBeta® Equity ETFs (the “Funds”) during the six months ended February 29, 2024 (the “Reporting Period”). A streamlined annual shareholder report covering the 12 months ended August 31, 2024 will be provided to the Funds’ shareholders, per new Securities and Exchange Commission requirements with a compliance date of July 24, 2024.

U.S. Equities

| • | Overall, U.S. equities rose during the Reporting Period. The Standard & Poor’s 500® Index (the “S&P 500 Index”) ended the Reporting Period with a return of 13.93%. The Russell 3000® Index generated a return of 13.76%. |

| • | Despite ongoing geopolitical tensions and persistent volatility, the market posted solid returns during the Reporting Period amid a backdrop of shifting consensus expectations around the Federal Reserve’s (“Fed”) policy path forward and generally broadening market leadership. |

| • | The Reporting Period began in September 2023 with a sharp pullback. |

| • | Although economic activity remained resilient, the S&P 500 Index declined mostly due to a pickup in soft landing concerns, surging energy prices and disinflationary pressures on corporate earnings. (A soft landing, in economics, is a cyclical downturn that avoids recession. It typically describes attempts by central banks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a significant increase in unemployment, or a hard landing.) |

| • | Concerns about a looming threat of a federal government shutdown, consumer impacts from student loan repayments resuming, and a strike against automakers by the United Auto Workers union that began in September further weighed on investor sentiment. |

| • | The Fed acted in line with consensus forecasts, keeping interest rates unchanged at 5.25%-5.50% in September. However, the Fed’s “higher for longer” narrative appeared to gain further recognition from investors. |

| • | During the fourth quarter of 2023, the S&P 500 Index enjoyed a double-digit gain, finishing the calendar year with the best fourth quarter since 2003. |

| • | The quarter saw a broadening of market leadership following the mega-cap dominance for most of 2023. |

| • | U.S. equity markets began the quarter with negative momentum, as investors digested a more resilient than consensus expected U.S. economy and a “higher for longer” Fed interest rate regime. |

| • | The market then shifted direction in November. |

| • | November saw the most significant easing in financial conditions of any month in more than four decades. |

| • | Market sentiment took a positive turn on the back of an overall shift in tonality from Fed officials signaling potential easing of monetary policy in 2024, a gradual cooldown in economic activity while the labor market remained resilient, and a rally across U.S. Treasuries marking one of the best monthly performances on record—all underpinning soft landing and disinflation traction themes. |

| • | The Fed held interest rates unchanged throughout the quarter, as growth of the U.S. economy slowed, the unemployment rate remained low despite abating job gains, and inflationary pressures continued to trend downwards. |

| • | Near the end of the quarter, there was a major shift in the Fed’s policy path expectations, with the Summary of Economic Projections median dot plot signaling 75 basis points of rate cuts in 2024. (A basis point is 1/100th of a percentage point. The Fed’s dot plot shows the interest rate projections of the members of the Federal Open Market Committee.) |

| • | U.S. economic data provided further evidence of disinflation momentum, with November’s annualized core Consumer Price Index dropping to its lowest level since September 2021 and core Personal Consumption Expenditure Index increasing 1.9% on a six-month annualized basis, measuring below the Fed’s inflation target of 2% for the first time in more than three years. |

| 1 |

MARKET REVIEW

| • | Market seasonality proved to be another tailwind to equities during the quarter, as November and December historically represent the strongest two-month period for U.S. stocks. |

| • | The S&P 500 Index rose in January 2024, albeit modestly. |

| • | Following an especially strong end to 2023, U.S. equity markets began the new calendar year with a more cautionary tone, driven by concerns regarding overvalued conditions and the Fed’s ability to match interest rate cut expectations from investors. |

| • | Yields across the U.S. Treasury curve, or spectrum of maturities, steepened, a headwind to equity valuations as traders repriced expectations regarding the path of monetary policy. |

| • | The trend of broadened market leadership witnessed in the last months of 2023 reversed course in January, with mega-cap stocks outperforming again. |

| • | Despite this defensive start, U.S. equities finished the month mostly higher, with the S&P 500 Index recording new record highs as economic releases and robust labor market data continued to underpin the prevailing soft landing narrative. |

| • | In February 2024, the S&P 500 Index notched a new all-time high, rallying for the fourth consecutive month as market leadership broadened from the “Magnificent Seven,” the group of high-performing and influential companies that drove U.S. equity performance for much of 2023.” |

| • | U.S. Treasury yields were notably higher on the back of resilient macroeconomic data and hawkish sentiment following the Fed’s January meeting, wherein Fed Chair Powell communicated it was not likely the Fed would cut interest rates in March 2024. (Hawkish suggests higher interest rates; opposite of dovish.) |

| • | The major headline of the month was the shift in market expectations for the timing of the first interest rate cut, which moved from March to June 2024 even as the broader disinflation theme remained intact. |

| • | Economic data remained robust, which helped ease concerns of a hard landing. |

| • | Concerns of a temporary U.S. government shutdown were subdued at the end of the month, as policymakers reached a timely temporary funding bill to keep government operations open through March 2024. |

| • | Corporate earnings were better than consensus feared, underpinned by both sales and earnings exceeding market forecasts on improved profit margins across most sectors. |

| • | During the Reporting Period overall, all capitalization segments within the U.S. equity market posted gains, with large-cap stocks, as measured by the Russell 1000® Index, performing best, followed by mid-cap stocks and then small-cap stocks, as measured by the Russell Midcap® Index and Russell 2000® Index, respectively. From a style perspective, growth-oriented stocks materially outperformed value-oriented stocks across the capitalization spectrum. (All as measured by the FTSE Russell indices.) |

| • | The best performing sectors within the S&P 500 Index during the Reporting Period were information technology, communication services and financials, while the weakest performing sectors were energy, utilities and consumer staples. |

International Equities

| • | Representing the developed international equity markets, the MSCI EAFE Index (net) returned 9.23% for the Reporting Period, lagging the U.S. equity market. |

| • | As the Reporting Period began in September 2023, international equity markets, like their U.S. counterpart, declined, marked by persistent inflation, contractionary economic concerns, particularly in Europe, and further interest rate hikes. Recession fears were renewed by a steep rise in oil prices. Further, a selloff in global bond markets put increased pressure on risk assets. |

| • | In Europe, concerns persisted around the contractionary effect of elevated interest rates on the economy as the European Central Bank (“ECB”) raised interest rates for the second time in the third calendar quarter. However, inflation in Europe fell to a two-year low, and the ECB suggested its September hike may be the last. |

| 2 |

MARKET REVIEW

| • | The U.K. equity market fared better than continental Europe, largely supported by its energy sector, which benefited from increased oil prices. The market also benefited from sterling, its currency, depreciation relative to the U.S. dollar. Additionally, U.K. markets showed signs of improving consumer confidence. The Bank of England (“BoE”) ended its run of 14 consecutive interest rate hikes in September. |

| • | The Japanese equity market fell in September, as concerns arose surrounding political tensions with China, which could impact tourism. |

| • | International equities rallied strongly in the fourth quarter of 2023, fueled by consensus expectations of interest rate cuts in 2024 amid falling inflation numbers and a fizzling out of the “higher for longer” narrative. |

| • | In Europe, equities were weak in October but then recovered to close out the year. Headline inflation in December ticked up from November; however, core inflation fell. |

| • | U.K. equities posted positive returns overall but lagged other geographies due to sterling appreciation and a large exposure to the underperforming energy sector. Although U.K. economic growth entered negative territory during the quarter, markets were buoyed by expectations of an ending rate hike cycle. As a result, domestic small-cap and mid-cap stocks performed especially well. |

| • | The Japanese equity market similarly posted positive, albeit modest, returns for the quarter. Yen appreciation was a headwind for Japanese equities. However, expectations of rate cuts and dovish U.S. Fed moves were positive news for Japanese equities. The December 2023 Bank of Japan Tankan survey signaled toward improving business sentiment. However, the Bank of Japan’s December meeting, though not featuring any policy or rate changes, slightly dampened consensus expectations of an imminent end to its negative policy rates. |

| • | The MSCI EAFE Index posted positive, though quite modest, returns in January 2024. While developed markets advanced on positive macroeconomic indicators, central banks tempered investor expectations of interest rate cuts in the first quarter of 2024. |

| • | European equities gained. The ECB kept its rates steady at its January meeting, recognizing a medium-term trend in declining inflation despite the uptick in the prior month. The ECB seemed to have little aversion towards maintaining elevated rates for as long as necessary, reiterating its commitment to a data-driven approach over the next few months. |

| • | U.K. equities posted a negative return overall in January. Signs of economic growth as well as a higher than anticipated December 2023 inflation reading pushed out consensus expectations of rate cuts from the BoE. |

| • | Despite beginning the calendar year with an earthquake and an accident at Tokyo Haneda airport, Japan was the best performing major region in January amidst foreign inflows, as investors rotated out of an underperforming Chinese equity market. Japanese equity markets were propelled by investor optimism around structural developments, such as corporate governance reforms requesting management plans around cost of capital and stock prices, as well as by the launch of the Nippon Individual Savings Account, which was widely expected to increase retail investor participation. The market was also boosted by yen depreciation, as the Bank of Japan elected not to change its negative rate policy at its January meeting. |

| • | The MSCI EAFE Index performed better in February 2024, as corporate earnings reports and positive economic data supported a solid monthly return. |

| • | European equities gained. Despite inflation in the region declining, the ECB reiterated its cautionary guidance regarding rate cuts. After reaching its highest level since July 2023 in January 2024, Europe’s Purchasing Managers’ Index (“PMI”) rose further in February, underscoring signs of improving economic activity in the region. |

| • | The U.K. equity market underperformed other international equity markets in February but still eked out a modestly positive return. Similar to the ECB, the BoE tempered interest rate cut expectations despite inflation coming in slightly below expectations. The U.K. equity market was further challenged by underwhelming corporate earnings and poor economic data that signaled the U.K. had entered a technical recession in the fourth quarter of 2023. |

| • | The Japanese equity market reached an all-time high in February, surpassing its previous high set 34 years earlier. Despite disappointing fourth quarter 2023 economic growth data, markets were enthused by the return of inflation in Japan, corporate governance reforms and stronger than consensus expected corporate earnings results, led mainly by large-cap stocks. |

| 3 |

MARKET REVIEW

| • | For the Reporting Period overall, eight of the eleven sectors in the MSCI EAFE Index posted positive total returns. The best performing sectors within the MSCI EAFE Index during the Reporting Period were information technology, industrials and financials, each posting a double-digit positive total return. The weakest performing sectors were consumer staples, utilities and energy. |

| • | The best performing countries within the MSCI EAFE Index were the Netherlands, Sweden and Israel. The weakest performing countries during the Reporting Period were Portugal, Hong Kong and Finland. |

Emerging Markets Equities

| • | Representing the emerging markets equity markets, the MSCI Emerging Markets Index (net) returned 4.93% during the Reporting Period, underperforming both the U.S. equity market and the developed international equity markets overall. |

| • | As the Reporting Period began in September 2023, emerging markets equities as a whole posted negative returns, as heightened expectations amid strong U.S. economic data that U.S. interest rates would remain higher for longer put pressure on emerging markets equities. |

| • | China remained top of mind for many investors with property market and local government debt issues reducing confidence in its equity market, which posted negative returns. |

| • | Elsewhere in Asia, India’s equity market rose, as the country’s long-term structural drivers remained strong and its near-term cyclical backdrop improved, with economic momentum advancing, corporate earnings growth broadening and corporate capital expenditures picking up. |

| • | In Latin America, the Brazilian equity market rose modestly, reporting economic growth that beat consensus expectations though high inflation kept investors alert to potential changes in economic policy. |

| • | In the EMEA (Europe, Middle East and Africa) region, Turkey’s equity market was the top performer, as domestic retail investor flows followed a signaled return to economic orthodoxy from the Turkish government. However, the equity markets of Poland, Greece and Saudi Arabia fell. |

| • | Emerging markets equities rallied in the fourth quarter of 2023 overall. |

| • | In October 2023, emerging markets equities as a whole fell as did most equity markets globally, as expectations for higher for longer interest rates, particularly in the U.S., and the outbreak of war in the Middle East reduced risk appetite, especially within emerging markets regions. |

| • | November 2023 was a strong month for emerging markets equities, as the view that developed markets interest rates had reached their peak supported equity market performance. All individual country constituents within the MSCI Emerging Markets Index posted positive returns, although China continued to struggle as consumer confidence remained weak amid ongoing property market troubles. |

| • | The MSCI Emerging Markets Index rose solidly in December 2023, as emerging markets proved beneficiaries of the widening view that U.S. interest rates were likely to fall more quickly than previously anticipated. A series of lower than consensus expected inflation reports in Europe and the U.S. were key drivers of such rate expectations. Adding to positive sentiment for emerging markets equities were high consensus earnings growth forecasts for emerging markets for 2024 and 2025. |

| • | The MSCI Emerging Markets Index fell in January 2024, suffering as strong U.S. economic data and hawkish messaging from the U.S. Fed altered interest rate cut altered consensus interest rate expectations. Despite China’s positive reported economic growth, its equity market was weakest, as the country continued to deal with issues of weak consumer confidence and property market concerns, with Evergrande, one of its largest real estate companies, going into liquidation during the month. Additionally, disappointment in the level of government support affected sentiment. Countries with strong trade links to China, including South Korea and Thailand, also suffered, as consensus expected export demand fell. On the other hand, India maintained its strong momentum from 2023, buoyed by corporate fundamentals and its government announcing a budget that reiterated a commitment to fiscal consolidation and introducing measures to encourage private capital expenditure. In Latin America, the rate differential between the U.S. and regional central banks was a drag, driving the equity markets of Chile, Peru and Brazil to negative monthly returns. |

| 4 |

MARKET REVIEW

| • | The MSCI Emerging Markets Index rose in February 2024, supported largely by a rebound in China’s equity market, which had recently hit five-year lows. China’s equity market was boosted by government intervention, including stock purchases by state-owned investment firms, and by data indicating better tourist activity during the lunar new year. |

| • | During the Reporting Period overall, the best performing sectors within the MSCI Emerging Markets Index were utilities, energy and information technology. The weakest performing sectors were communication services, real estate and materials. |

| • | The best performing countries within the MSCI Emerging Markets Index during the Reporting Period were Egypt, Poland, Colombia, Peru and India. The weakest performing countries were Hong Kong, Thailand, China, Czech Republic and Chile. |

Fund Changes and Highlights

No material changes were made to the Funds during the Reporting Period.

| 5 |

Index Definitions and Industry Terms

S&P 500 Index is a U.S. stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ. The S&P 500® Index components and their weightings are determined by S&P Dow Jones Indices.

Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. The Russell 1000® Index is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the U.S. market. The Russell 1000® Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are reflected.

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. The Russell 2000® Index includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

Russell 3000® Index is a market capitalization weighted equity index maintained by the FTSE Russell that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks which represent about 98% of all U.S incorporated equity securities. It is not possible to invest directly in an index.

Russell MidCap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. The Russell Midcap® Index includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 31% of the total market capitalization of the Russell 1000® Index companies. The Russell Midcap® Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The Russell Midcap® Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap opportunity set.

MSCI EAFE® Index is a market capitalization-weighted composite of securities in 21 developed markets. The MSCI EAFE® Index approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction for withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI® Inc. uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. The MSCI EAFE® Index is unmanaged and the figures for the MSCI EAFE® Index do not include any deduction for fees or expenses.

MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets countries. It is not possible to invest directly in an unmanaged index.

| 6 |

FUND BASICS

ActiveBeta® Emerging Markets Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$30.70 | |||

|

Net Asset Value (NAV)1 |

$30.97 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

GS ActiveBeta® Emerging Markets Equity Index3 |

MSCI Emerging Market Index4 | ||||

| Shares | 5.95% | 5.49% | 6.93% | 4.93% | ||||

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® Emerging Markets Equity Index (the “Index”) is designed to deliver exposure to equity securities of emerging market issuers. The Index seeks to capture common sources of active equity returns, including value (i.e., how attractively a stock is priced relative to its “fundamentals”, such as book value or free cash flow), momentum (i.e., whether a company’s share price is trending up or down), quality (i.e., profitability) and low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The index provider for the reference index on which the Index is based may delay or change a scheduled rebalancing or reconstitution of such reference index or the implementation of certain rules at its sole discretion. In such circumstances, the scheduled rebalancing or reconstitution of the Index may likewise be delayed or changed. It is not possible to invest directly in an unmanaged index. |

| 4 |

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets countries. It is not possible to invest directly in an unmanaged index. |

|

|

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 7 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | Country | |||

|

Taiwan Semiconductor Manufacturing Co. Ltd. |

6.8% | Information Technology | Taiwan | |||

|

Samsung Electronics Co. Ltd. |

3.4 | Information Technology | South Korea | |||

|

Tencent Holdings Ltd. |

2.8 | Communication Services | China | |||

|

Alibaba Group Holding Ltd. |

1.7 | Consumer Discretionary | China | |||

|

Reliance Industries Ltd. |

1.0 | Energy | India | |||

|

Infosys Ltd. |

0.9 | Information Technology | India | |||

|

MediaTek, Inc. |

0.8 | Information Technology | Taiwan | |||

|

Tata Consultancy Services Ltd. |

0.7 | Information Technology | India | |||

|

China Construction Bank Corp., Class H |

0.7 | Financials | China | |||

|

PDD Holdings, Inc. ADR |

0.7 | Consumer Discretionary | China | |||

| 5 |

The top 10 holdings may not be representative of the Fund’s future investments. |

|

FUND VS BENCHMARK 6 |

| 6 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by MSCI. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 1.3% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 7 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® Emerging Markets Equity Index. |

| 8 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 9 |

FUND BASICS

ActiveBeta® Europe Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$35.17 | |||

|

Net Asset Value (NAV)1 |

$35.18 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

ActiveBeta® Europe Equity Index3 |

MSCI Europe Index4 |

||||||

| Shares | 7.09% | 7.24% | 7.15% | 8.17% | ||||||

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® Europe Equity Index (the “Index”) is designed to deliver exposure to equity securities of developed market issuers in Europe. The Index seeks to capture common sources of active equity returns, including value (i.e., how attractively a stock is priced relative to its “fundamentals”, such as book value or free cash flow), momentum (i.e., whether a company’s share price is trending up or down), quality (i.e., profitability) and low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The index provider for the reference index on which the Index is based may delay or change a scheduled rebalancing or reconstitution of such reference index or the implementation of certain rules at its sole discretion. In such circumstances, the scheduled rebalancing or reconstitution of the Index may likewise be delayed or changed. It is not possible to invest directly in an unmanaged index. |

| 4 |

The MSCI Europe Index captures large and mid-cap representation across 15 Developed Markets countries. It is not possible to invest directly in an unmanaged index. |

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 10 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | Country | |||

|

Novo Nordisk A/S, Class B |

3.5% | Health Care | Denmark | |||

|

ASML Holding NV |

3.0 | Information Technology | Netherlands | |||

|

Nestle SA |

2.1 | Consumer Staples | United States | |||

|

LVMH Moet Hennessy Louis Vuitton SE |

2.1 | Consumer Discretionary | France | |||

|

Novartis AG |

1.8 | Health Care | Switzerland | |||

|

Roche Holding AG |

1.6 | Health Care | United States | |||

|

AstraZeneca PLC |

1.5 | Health Care | United Kingdom | |||

|

SAP SE |

1.5 | Information Technology | Germany | |||

|

Shell PLC |

1.5 | Energy | Netherlands | |||

|

TotalEnergies SE |

1.2 | Energy | France | |||

| 5 |

The top 10 holdings may not be representative of the Fund’s future investments. |

|

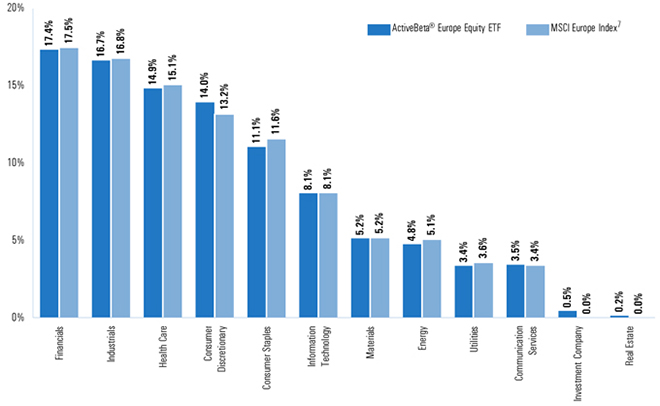

FUND VS BENCHMARK 6 |

| 6 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by MSCI. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.5% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 7 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® Europe Equity Index. |

| 11 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 12 |

FUND BASICS

ActiveBeta® International Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$33.38 | |||

|

Net Asset Value (NAV)1 |

$33.34 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

GS ActiveBeta® Intl Equity Index3 |

MSCI World ex USA Index4 |

||||||

| Shares | 7.84% | 7.94% | 7.85% | 9.07% | ||||||

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® International Equity Index (the “Index”) is designed to deliver exposure to equity securities of developed market issuers outside of the United States. The Index seeks to capture common sources of active equity returns, including value (i.e., how attractively a stock is priced relative to its “fundamentals”, such as book value or free cash flow), momentum (i.e., whether a company’s share price is trending up or down), quality (i.e., profitability) and low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The index provider for the reference index on which the Index is based may delay or change a scheduled rebalancing or reconstitution of such reference index or the implementation of certain rules at its sole discretion. In such circumstances, the scheduled rebalancing or reconstitution of the Index may likewise be delayed or changed. It is not possible to invest directly in an unmanaged index. |

| 4 |

The MSCI World ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries. It is not possible to invest directly in an unmanaged index. |

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 13 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | Country | |||

|

Novo Nordisk A/S, Class B |

2.0% | Health Care | Denmark | |||

|

ASML Holding NV |

1.5 | Information Technology | Netherlands | |||

|

LVMH Moet Hennessy Louis Vuitton SE |

1.2 | Consumer Discretionary | France | |||

|

Nestle SA |

1.2 | Consumer Staples | United States | |||

|

Novartis AG |

1.0 | Health Care | Switzerland | |||

|

Roche Holding AG |

0.9 | Health Care | United States | |||

|

AstraZeneca PLC |

0.8 | Health Care | United Kingdom | |||

|

SAP SE |

0.8 | Information Technology | Germany | |||

|

Shell PLC |

0.8 | Energy | Netherlands | |||

|

Constellation Software, Inc. |

0.7 | Information Technology | Canada | |||

| 5 |

The top 10 holdings may not be representative of the Fund’s future investments. |

|

FUND VS BENCHMARK 6 |

| 6 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by MSCI. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.2% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 7 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® International Equity Index. |

| 14 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 15 |

FUND BASICS

ActiveBeta® Japan Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$37.90 | |||

|

Net Asset Value (NAV)1 |

$37.93 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

GS ActiveBeta® Japan Equity Index3 |

MSCI Japan Index4 |

||||||

| Shares | 12.39% | 12.28% | 12.40% | 14.13% | ||||||

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® Japan Equity Index (the “Index”) is designed to deliver exposure to equity securities of Japan issuers. The Index seeks to capture common sources of active equity returns, including value (i.e., how attractively a stock is priced relative to its “fundamentals”, such as book value or free cash flow), momentum (i.e., whether a company’s share price is trending up or down), quality (i.e., profitability) and low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The index provider for the reference index on which the Index is based may delay or change a scheduled rebalancing or reconstitution of such reference index or the implementation of certain rules at its sole discretion. In such circumstances, the scheduled rebalancing or reconstitution of the Index may likewise be delayed or changed. It is not possible to invest directly in an unmanaged index. |

| 4 |

The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market. It is not possible to invest directly in an unmanaged index. |

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 16 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | ||

|

Toyota Motor Corp. |

5.2% | Automobiles | ||

|

Mitsubishi UFJ Financial Group, Inc. |

2.7 | Banks | ||

|

Tokyo Electron Ltd. |

2.6 | Semiconductors & Semiconductor Equipment | ||

|

Sony Group Corp. |

2.0 | Household Durables | ||

|

Mitsubishi Corp. |

2.0 | Trading Companies & Distributors | ||

|

Hitachi Ltd. |

1.8 | Industrial Conglomerates | ||

|

Keyence Corp. |

1.8 | Electronic Equipment, Instruments & Components | ||

|

Sumitomo Mitsui Financial Group, Inc. |

1.7 | Banks | ||

|

Mitsui & Co. Ltd. |

1.4 | Trading Companies & Distributors | ||

|

Shin-Etsu Chemical Co. Ltd. |

1.4 | Chemicals | ||

5 The top 10 holdings may not be representative of the Fund’s future investments.

|

FUND VS BENCHMARK 6 |

| 6 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by MSCI. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.2% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 7 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® Japan Equity Index. |

| 17 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 18 |

FUND BASICS

ActiveBeta® U.S. Large Cap Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$100.75 | |||

|

Net Asset Value (NAV)1 |

$100.79 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

GS ActiveBeta® U.S. Large Cap Equity Index3 |

S&P 500 Index4 |

||||||

| Shares | 14.68% | 14.61% | 14.72% | 13.93% |

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® U.S. Large Cap Equity Index (the “Index”) is designed to deliver exposure to equity securities of large capitalization U.S. issuers. The Index seeks to capture common sources of active equity returns, including value (i.e., how attractively a stock is priced relative to its “fundamentals”, such as book value or free cash flow), momentum (i.e., whether a company’s share price is trending up or down), quality (i.e., profitability) and low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The index provider for the reference index on which the Index is based may delay or change a scheduled rebalancing or reconstitution of such reference index or the implementation of certain rules at its sole discretion. In such circumstances, the scheduled rebalancing or reconstitution of the Index may likewise be delayed or changed. It is not possible to invest directly in an unmanaged index. |

| 4 |

The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 19 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | ||

|

Microsoft Corp. |

6.2% | Software | ||

|

Apple, Inc. |

5.5 | Technology Hardware, Storage & Peripherals | ||

|

NVIDIA Corp. |

3.7 | Semiconductors & Semiconductor Equipment | ||

|

Amazon.com, Inc. |

3.1 | Broadline Retail | ||

|

Meta Platforms, Inc., Class A |

2.5 | Interactive Media & Services | ||

|

Alphabet, Inc., Class A |

1.7 | Interactive Media & Services | ||

|

Alphabet, Inc., Class C |

1.6 | Interactive Media & Services | ||

|

Eli Lilly & Co. |

1.4 | Pharmaceuticals | ||

|

Broadcom, Inc. |

1.0 | Semiconductors & Semiconductor Equipment | ||

|

Berkshire Hathaway, Inc., Class B |

1.0 | Financial Services | ||

| 5 |

The top 10 holdings may not be representative of the Fund’s future investments. |

|

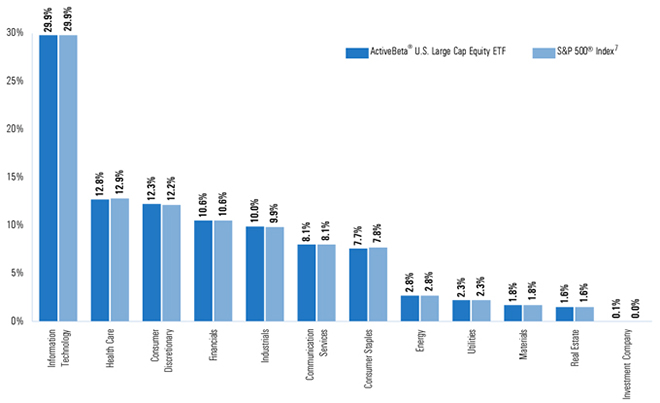

FUND VS BENCHMARK 6 |

| 6 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by Standard & Poor’s. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.1% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 7 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® U.S. Large Cap Equity Index. |

| 20 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 21 |

FUND BASICS

ActiveBeta® U.S. Small Cap Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$63.48 | |||

|

Net Asset Value (NAV)1 |

$63.63 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

ActiveBeta® U.S. Small Cap Equity ETF Index3 |

Russell 2000® Index4 |

||||||

| Shares | 8.83% | 8.62% | 8.90% | 8.97% | ||||||

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® U.S. Small Cap Equity Index (the “Index”) is designed to deliver exposure to equity securities of small capitalization U.S. issuers. The Index seeks to capture common sources of active equity returns, including value (i.e., how attractively a stock is priced relative to its “fundamentals”, such as book value or free cash flow), momentum (i.e., whether a company’s share price is trending up or down), quality (i.e., profitability) and low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The index provider for the reference index on which the Index is based may delay or change a scheduled rebalancing or reconstitution of such reference index or the implementation of certain rules at its sole discretion. In such circumstances, the scheduled rebalancing or reconstitution of the Index may likewise be delayed or changed. It is not possible to invest directly in an unmanaged index. |

| 4 |

The Russell 2000® Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. |

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 22 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | ||

|

Super Micro Computer, Inc. |

1.3% | Technology Hardware, Storage & Peripherals | ||

|

Comfort Systems USA, Inc. |

0.5 | Construction & Engineering | ||

|

Applied Industrial Technologies, Inc. |

0.4 | Trading Companies & Distributors | ||

|

Simpson Manufacturing Co., Inc. |

0.4 | Building Products | ||

|

Atkore, Inc. |

0.4 | Electrical Equipment | ||

|

Alpha Metallurgical Resources, Inc. |

0.4 | Metals & Mining | ||

|

Boise Cascade Co. |

0.4 | Trading Companies & Distributors | ||

|

Abercrombie & Fitch Co., Class A |

0.4 | Specialty Retail | ||

|

UFP Industries, Inc. |

0.4 | Building Products | ||

|

GMS, Inc. |

0.4 | Trading Companies & Distributors | ||

| 5 |

The top 10 holdings may not be representative of the Fund’s future investments. |

|

FUND VS BENCHMARK 6 |

| 6 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by Russell Investments. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.6% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 7 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® U.S. Small Cap Equity Index. |

| 23 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 24 |

FUND BASICS

ActiveBeta® World Low Vol Plus Equity ETF

as of February 29, 2024

|

FUND SNAPSHOT |

|

As of February 29, 2024 |

||||

|

Market Price1 |

$45.79 | |||

|

Net Asset Value (NAV)1 |

$45.76 | |||

| 1 |

The Market Price is the price at which the Fund’s shares are trading on the Cboe BZX Exchange, Inc (“Cboe BZX”). The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on Cboe BZX at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com/ETFs. |

|

PERFORMANCE REVIEW |

| September 1, 2023-February 29, 2024 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

GS ActiveBeta® World Low Vol Plus Equity Index3 |

|||||

| Shares | 11.90% | 11.87% | 11.75% | |||||

| 2 |

Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00pm EST and do not reflect the returns you would receive if you traded shares at other times. Total returns for periods less than one full year are not annualized. |

| 3 |

The Goldman Sachs ActiveBeta® World Low Vol Plus Equity Index (the “Index”) is designed to deliver exposure is designed to deliver exposure to large and mid-capitalization equity securities of developed market issuers, including the United States. The Index seeks to capture common sources of active equity returns, including low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time), value (i.e., how attractively a stock is priced relative to its “fundamentals,” such as book value and free cash flow), momentum (i.e., whether a company’s share price is trending up or down), and quality (i.e., profitability). The Index seeks to provide exposure to these factors with an emphasis on the low volatility factor. The index is reconstituted and rebalanced quarterly. It is not possible to invest directly in an unmanaged index. |

|

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/ETFs. to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. |

| 25 |

FUND BASICS

|

TOP TEN HOLDINGS AS OF 2/29/24 5 |

| Holding | % of Net Assets | Line of Business | Country | |||

|

Microsoft Corp. |

2.9% | Information Technology | United States | |||

|

Apple, Inc. |

2.9 | Information Technology | United States | |||

|

O’Reilly Automotive, Inc. |

1.2 | Consumer Discretionary | United States | |||

|

Amazon.com, Inc. |

1.2 | Consumer Discretionary | United States | |||

|

Berkshire Hathaway, Inc., Class B |

1.2 | Financials | United States | |||

|

Walmart, Inc. |

1.1 | Consumer Staples | United States | |||

|

NVIDIA Corp. |

1.0 | Information Technology | United States | |||

|

Meta Platforms, Inc., Class A |

1.0 | Communication Services | United States | |||

|

International Business Machines Corp. |

0.9 | Information Technology | United States | |||

|

Home Depot, Inc. (The) |

0.8 | Consumer Discretionary | United States | |||

| 4 |

The top 10 holdings may not be representative of the Fund’s future investments. |

|

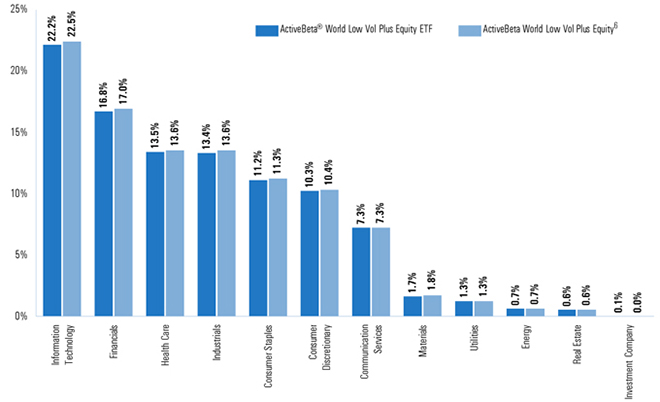

FUND VS BENCHMARK 5 |

| 5 |

Country and sector classifications for securities may differ between the above listing and the Schedule of Investments due to differing classification methodologies. The classification methodology used for the above listing is as set forth by Standard & Poor’s. The Fund’s composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the chart above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investment in the securities lending reinvestment vehicle, if any). Underlying sector allocation of exchange-traded funds held by the Fund are not reflected in the chart above. Investments in the securities lending vehicle represented 0.1% of the Fund’s net assets as of February 29, 2024. Figures above may not sum to 100% due to rounding. |

| 6 |

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Goldman Sachs ActiveBeta® World Low Vol Plus Equity Index. |

| 26 |

FUND BASICS

|

For more information about the Fund, please refer to www.GSAMFUNDS.com/ETFs. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 27 |

GOLDMAN SACHS ACTIVEBETA® EMERGING MARKETS EQUITY ETF

| Shares |

Description | Value | ||||||

| Common Stocks – 96.8% |

| |||||||

| Brazil – 4.0% | ||||||||

| 667,886 | Ambev SA (Consumer Staples) | $ | 1,691,004 | |||||

| 499,804 | B3 SA – Brasil Bolsa Balcao (Financials) | 1,290,589 | ||||||

| 403,110 | Banco Bradesco SA (Financials) | 997,908 | ||||||

| 92,046 | Banco do Brasil SA (Financials) | 1,071,877 | ||||||

| 64,908 | Banco Santander Brasil SA (Financials) | 373,616 | ||||||

| 543,960 | BB Seguridade Participacoes SA (Financials) | 3,650,011 | ||||||

| 190,031 | CCR SA (Industrials) | 527,030 | ||||||

| 121,391 | Centrais Eletricas Brasileiras SA (Utilities) | 1,062,765 | ||||||

| 94,045 | CPFL Energia SA (Utilities) | 669,850 | ||||||

| 48,079 | Energisa SA (Utilities) | 491,952 | ||||||

| 76,943 | Engie Brasil Energia SA (Utilities) | 650,709 | ||||||

| 279,333 | Equatorial Energia SA (Utilities) | 1,921,569 | ||||||

| 48,138 | Hypera SA (Health Care) | 318,553 | ||||||

| 84,762 | Klabin SA (Materials) | 385,030 | ||||||

| 257,373 | Lojas Renner SA (Consumer Discretionary) | 818,430 | ||||||

| 1,328,900 | Magazine Luiza SA (Consumer Discretionary)* | 569,683 | ||||||

| 306,273 | Natura & Co. Holding SA (Consumer Staples)* | 1,005,366 | ||||||

| 489,805 | Petroleo Brasileiro SA (Energy) | 4,063,430 | ||||||

| 76,179 | PRIO SA (Energy) | 670,159 | ||||||

| 552,715 | Raia Drogasil SA (Consumer Staples) | 2,963,446 | ||||||

| 85,225 | Suzano SA (Materials) | 966,546 | ||||||

| 201,741 | Telefonica Brasil SA (Communication Services) | 2,212,039 | ||||||

| 273,596 | TIM SA (Communication Services) | 1,000,521 | ||||||

| 442,527 | Vale SA (Materials) | 5,966,386 | ||||||

| 133,795 | Vibra Energia SA (Consumer Discretionary) | 696,354 | ||||||

| 236,849 | WEG SA (Industrials) | 1,748,964 | ||||||

|

|

|

|||||||

| 37,783,787 | ||||||||

|

|

||||||||

| Chile – 0.4% | ||||||||

| 918,721 | Cencosud SA (Consumer Staples) | 1,648,352 | ||||||

| 231,540 | Empresas CMPC SA (Materials) | 410,636 | ||||||

| 82,031 | Empresas Copec SA (Energy) | 525,940 | ||||||

| 2,982,330 | Enel Americas SA (Utilities) | 303,780 | ||||||

| 321,705 | Falabella SA (Consumer Discretionary)* | 815,062 | ||||||

|

|

|

|||||||

| 3,703,770 | ||||||||

|

|

||||||||

| China – 27.3% | ||||||||

| 193,995 | 360 Security Technology, Inc., Class A (Information Technology)* | 236,125 | ||||||

| Shares |

Description | Value | ||||||

| Common Stocks – (continued) |

| |||||||

| China – (continued) | ||||||||

| 358,131 | 37 Interactive Entertainment Network Technology Group Co. Ltd., Class A (Communication Services) | $ | 968,237 | |||||

| 2,716,985 | Agricultural Bank of China Ltd., Class A (Financials) | 1,579,982 | ||||||

| 4,262,766 | Agricultural Bank of China Ltd., Class H (Financials) | 1,753,284 | ||||||

| 125,685 | Aier Eye Hospital Group Co. Ltd., Class A (Health Care) | 255,548 | ||||||

| 19,798 | Airtac International Group (Industrials) | 757,860 | ||||||

| 82,404 | Akeso, Inc. (Health Care)*(a) | 495,763 | ||||||

| 1,694,540 | Alibaba Group Holding Ltd. (Consumer Discretionary) | 15,779,170 | ||||||

| 614,409 | Alibaba Health Information Technology Ltd. (Consumer Staples)* | 269,973 | ||||||

| 449,336 | Aluminum Corp. of China Ltd., Class A (Materials) | 377,292 | ||||||

| 1,254,817 | Aluminum Corp. of China Ltd., Class H (Materials) | 628,306 | ||||||

| 63,185 | Anhui Conch Cement Co. Ltd., Class A (Materials) | 209,937 | ||||||

| 60,318 | Anker Innovations Technology Co. Ltd., Class A (Information Technology) | 683,943 | ||||||

| 170,659 | ANTA Sports Products Ltd. (Consumer Discretionary) | 1,673,063 | ||||||

| 16,002 | Autohome, Inc. ADR (Communication Services) | 415,892 | ||||||

| 162,417 | Baidu, Inc., Class A (Communication Services)* | 2,065,273 | ||||||

| 1,822,276 | Bank of Beijing Co. Ltd., Class A (Financials) | 1,310,071 | ||||||

| 372,194 | Bank of Changsha Co. Ltd., Class A (Financials) | 402,400 | ||||||

| 2,923,030 | Bank of China Ltd., Class A (Financials) | 1,813,392 | ||||||

| 8,968,969 | Bank of China Ltd., Class H (Financials) | 3,528,564 | ||||||

| 1,933,364 | Bank of Communications Co. Ltd., Class A (Financials) | 1,682,411 | ||||||

| 2,384,594 | Bank of Communications Co. Ltd., Class H (Financials) | 1,565,606 | ||||||

| 193,627 | Bank of Hangzhou Co. Ltd., Class A (Financials) | 297,753 | ||||||

| 1,317,967 | Bank of Jiangsu Co. Ltd., Class A (Financials) | 1,402,978 | ||||||

| 608,526 | Bank of Nanjing Co. Ltd., Class A (Financials) | 738,989 | ||||||

| 997,546 | Bank of Shanghai Co. Ltd., Class A (Financials) | 904,060 | ||||||

| 343,233 | Bank of Suzhou Co. Ltd., Class A (Financials) | 337,743 | ||||||

| 456,232 | Baoshan Iron & Steel Co. Ltd., Class A (Materials) | 422,340 | ||||||

| 37,509 | BeiGene Ltd. (Health Care)* | 507,863 | ||||||

| 28 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS ACTIVEBETA® EMERGING MARKETS EQUITY ETF

| Shares |

Description | Value | ||||||

| Common Stocks – (continued) |

| |||||||

| China – (continued) | ||||||||

| 245,583 | Beijing Enterprises Holdings Ltd. (Utilities) | $ | 925,391 | |||||

| 6,317 | Beijing Kingsoft Office Software, Inc., Class A (Information Technology) | 237,548 | ||||||

| 64,761 | Beijing Wantai Biological Pharmacy Enterprise Co. Ltd., Class A (Health Care) | 661,070 | ||||||

| 187,161 | Beijing Yanjing Brewery Co. Ltd., Class A (Consumer Staples) | 227,547 | ||||||

| 471,212 | Beijing-Shanghai High Speed Railway Co. Ltd., Class A (Industrials) | 330,262 | ||||||

| 62,206 | Bloomage Biotechnology Corp. Ltd., Class A (Health Care) | 551,935 | ||||||

| 1,042,510 | BOE Technology Group Co. Ltd., Class A (Information Technology) | 577,303 | ||||||

| 2,031,813 | Bosideng International Holdings Ltd. (Consumer Discretionary) | 1,025,146 | ||||||

| 12,493 | BYD Co. Ltd., Class A (Consumer Discretionary) | 331,517 | ||||||

| 56,472 | BYD Co. Ltd., Class H (Consumer Discretionary) | 1,394,344 | ||||||

| 114,796 | BYD Electronic International Co. Ltd. (Information Technology) | 434,034 | ||||||

| 166,904 | By-health Co. Ltd., Class A (Consumer Staples) | 391,475 | ||||||

| 136,061 | C&D International Investment Group Ltd. (Real Estate) | 221,415 | ||||||

| 363,177 | Caitong Securities Co. Ltd., Class A (Financials) | 402,228 | ||||||

| 440,955 | CECEP Solar Energy Co. Ltd., Class A (Utilities) | 332,923 | ||||||

| 996,903 | CGN Power Co. Ltd., Class A (Utilities) | 534,061 | ||||||

| 3,593,548 | CGN Power Co. Ltd., Class H (Utilities)(a) | 1,092,459 | ||||||

| 12,284 | Changchun High & New Technology Industry Group, Inc., Class A (Health Care) | 219,076 | ||||||

| 402,335 | Changjiang Securities Co. Ltd., Class A (Financials) | 307,115 | ||||||

| 3,763,641 | China Cinda Asset Management Co. Ltd., Class H (Financials) | 360,557 | ||||||

| 2,699,302 | China CITIC Bank Corp. Ltd., Class H (Financials) | 1,437,780 | ||||||

| 1,157,315 | China Communications Services Corp. Ltd., Class H (Industrials) | 492,267 | ||||||

| 1,164,718 | China Construction Bank Corp., Class A (Financials) | 1,131,540 | ||||||

| 11,095,407 | China Construction Bank Corp., Class H (Financials) | 6,916,205 | ||||||

| 1,200,550 | China Energy Engineering Corp. Ltd., Class A (Industrials) | 363,235 | ||||||

| Shares |

Description | Value | ||||||

| Common Stocks – (continued) |

| |||||||

| China – (continued) | ||||||||

| 1,256,618 | China Everbright Bank Co. Ltd., Class A (Financials) | $ | 561,578 | |||||

| 2,475,872 | China Everbright Bank Co. Ltd., Class H (Financials) | 774,817 | ||||||

| 1,540,342 | China Feihe Ltd. (Consumer Staples)(a) | 767,338 | ||||||

| 291,842 | China Galaxy Securities Co. Ltd., Class A (Financials) | 492,125 | ||||||

| 1,057,280 | China Galaxy Securities Co. Ltd., Class H (Financials) | 556,406 | ||||||

| 301,977 | China Great Wall Securities Co. Ltd., Class A (Financials) | 331,933 | ||||||