Annual Report and Accounts 2019/20 Bring Energy to Life

National Grid plc Annual Report and Accounts 2019/20 Bring Energy to Life National Grid operates at the heart of the energy system, connecting millions of people safely, reliably and efficiently to the energy they use every day.

Highlights Contents We have continued to make strategic and 1. Strategic Report operational progress while maintaining Business model 2 excellent safety levels across all our Chairman’s Statement 8 networks. We have retained a focus Chief Executive’s review 10 Evolving our strategy for the future 12 on our environmental sustainability Our business environment 13 record and employee engagement. Delivering against our strategy 16 Progress against our strategy 18 Innovation 21 Group financial highlights Internal control and risk management 22 Group Return on Viability statement 26 Statutory EPS (p)* Underlying EPS (p)* Equity (RoE) % Financial review 28 102.� ��.� 12.3 Principal operations – UK 38 ��.2 ��.2 11.� 11.� Principal operations – US 40 National Grid Ventures and other activities 42 Our stakeholders 44.3 3�.� – Section 172(1) statement 44 Our commitment to being a responsible business 48 Task Force on Climate-related 19/20 18/19 17/18 19/20 18/19 17/18 19/20 18/19 17/18 Financial Disclosures (TCFD) 57 * From continuing operations 2. Corporate Governance Letter from the Chairman 64 Group operational highlights Performance evaluation 74 Audit Committee 76 Group safety Scope 1 and 2 Finance Committee 82 performance (lost greenhouse Safety, Environment and time injuries per gas emissions Health Committee 83 100,000 hours worked (CO2 equivalent, Employee in 12-month period) m tonnes) engagement (%) Nominations Committee 84 Diversity 85 0.12 �� �� 0.10 0.10 �3 Statement of application of and �.0 �.� �.� compliance with the UK Corporate Governance Code 2018 86 Index to the Directors’ Report and other disclosures 87 Directors’ Remuneration Report 88 3. Financial Statements 19/20 18/19 17/18 19/20 18/19 17/18 19/20 18/19 17/18 Statement of Directors’ responsibilities 109 Independent auditor’s report 110 4. Additional Information Scan here to view the story Further reading The business in detail 217 Internal control and risk factors 227 Shareholder information 231 Online report Other disclosures 236 The PDF of our Annual Report and Other unaudited financial information 240 Accounts 2019/20 includes a full search facility. You can find the Commentary on consolidated document by visiting the ‘About us’ financial statements 250 section at www.nationalgrid.com/ Definitions and glossary of terms 254 about-us/annual-report-and- accounts. Want more information or help? 258 Cautionary statement 259 QR codes Throughout the report there are QR codes that you can scan to easily view content online. Simply open your camera app on your smartphone The job that can’t wait device to scan the code. Reporting currency We believe that people are the key Our financial results are reported in sterling. We to unlocking a clean energy future, convert our US business results at the weighted and we ran a recruitment campaign average exchange rate during the year, which for in the UK to attract talent to ‘the More detail 2019/20 was $1.29 to £1 (2018/19: $1.31 to £1). Throughout this report you can job that can’t wait’. We were Alternative performance measures delighted with the response to the find links to further detail within this document. In addition to IFRS figures, management also campaign, which saw a sevenfold use a number of ‘alternative measures’ to assess increase in applications to our performance. Definitions and reconciliations to Advanced Apprenticeship scheme statutory financial information can be found on and started a national conversation pages 240 – 249. These measures are highlighted about the importance of STEM at with the symbol above. all stages of education. 1

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Business model What we do National Grid plc is one of the world’s largest investor-owned energy utilities, committed to delivering electricity and gas safely, reliably and efficiently to the customers and communities we serve. Our core regulated businesses Core regulated National Grid owns a range of high-quality, long-term assets. All our assets share low commercial risk profiles and are typically UK Electricity US Regulated supported by long-term contracts or stable regulatory arrangements. Our core regulated businesses in the UK and US generated over Electricity Electricity 90% of our operating profits this year. Our UK electricity business comprises both We own and operate transmission facilities the electricity transmission network (ET) and across upstate New York, Massachusetts, Our other energy businesses a separate Electricity System Operator (ESO). New Hampshire, Rhode Island and Vermont. Supporting the core regulated businesses, we also own a diverse and growing portfolio of We own the high-voltage transmission Our electric locations by state: commercial energy businesses also operating network in England and Wales. We are • New York; across the UK and US. These include our Grain responsible for ensuring electricity is • Massachusetts; and LNG terminal and electricity interconnectors transported safely and efficiently from between the UK and continental Europe, which where it is produced; reaching homes and • Rhode Island. generate revenue by selling capacity to store businesses safely, reliably and efficiently. or transmit energy. Our UK metering business We also facilitate the connection of assets generates revenue primarily through meter to the transmission system. 9,109 rentals. We also own a commercial property miles (14,659 kilometres) of overhead lines business which develops and sells surplus land. 4,481 (2018/19: 8,881 miles; 14,293 kilometres) Our business is organised into segments, miles (7,212 kilometres) of overhead lines based upon activity and location (2018/19: 4,481 miles; 7,212 kilometres) Gas We own and operate gas distribution Key: UK Electricity Transmission networks across the northeastern US UK Gas Transmission 1,391 and are responsible for connecting millions miles (2,239 kilometres) of underground cable US Regulated of customers to the energy they use. (2018/19: 1,437 miles; 2,312 kilometres) National Grid Ventures and other activities Our gas locations by state: Our role as ESO • New York; The ESO now operates as a separate company • Massachusetts; and within National Grid effective from 1 April 2019. We are responsible for making sure • Rhode Island. Statutory operating profit (%) supply and demand of electricity is balanced in real time across Great Britain (GB). While 35,682 47% we operate as the ESO across GB, we do miles (57,425 kilometres) of gas pipelines 12% not own the transmission assets in Scotland. (2018/19: 35,560 miles; 57,228 kilometres) 32% 9% Although the ESO is legally separate from ET, its results are still presented to the Board as part of the UK segment, and therefore no change has been made to our reportable operating segments. Underlying operating profit (%) UK Gas Transmission 34% 12% Our UK Gas Transmission (GT) business 47% comprises both the gas transmission assets 7% and an integrated gas system operator. We also own and operate the high-pressure gas transmission network in Great Britain. We are responsible for making sure GB’s RAV, rate base and other assets (%) gas is transported safely and efficiently from where it is produced to where it is 31% consumed. 14% 46% As the Gas System Operator we are 9% responsible for ensuring that supply and demand are balanced in real time on a day-to-day basis. 4,740 miles (7,630 kilometres) of high-pressure pipe (2018/19: 4,760 miles; 7,660 kilometres) 2

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Business Model: What we do National Grid Ventures and other activities National Grid Ventures (NGV) manages our diverse portfolio of energy businesses that are similar to our core regulated operations. This operating segment represents our main strategic growth area outside our regulated core business, in competitive markets across the US and the UK. The business comprises commercial operations in energy metering, electricity interconnectors, renewables development and the storage of liquefied natural gas (LNG) in the UK. In July 2019, we completed the acquisition of Geronimo, a leading wind and solar developer in North America. In December, we announced the start of commercial operations at the 200 MW Crocker Wind Farm in Clark County, South Dakota. Our other activities that do not form part of any of the segments over the page or NGV, primarily relate to our UK property business together with insurance and corporate activities in the UK and US, and the Group’s investments in technology and innovation companies through National Grid Partners (NGP). 8.8 million metering: gas meters (2018/19: 9.9 million) 1,000,000 m3 liquefied natural gas tank space (2018/19: 1,000,000 m3) 7.8 GW GW capacity of interconnectors in operation or under construction (2018/19: 7.8 GW) 3

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Business model How we operate Our operating model creates a stable, reliable and sustainable business that benefits our What we rely on The key internal resources that we rely on to do business are: • our physical assets that move the energy; • appropriate funding that allows us to invest in our workforce and assets; and • our talented workforce that ensures energy is moved efficiently and reliably. We also rely on maintaining strong relationships with a number of key external stakeholder groups to ensure we best meet their needs and maintain our licence to operate (see pages 44 – 47). How we do business We combine these input factors with our technical expertise to achieve our purpose and vision. We do all of this in accordance with our culture and values, which guide everything that we do. Our strategy is designed to maintain and develop our business model and is supported by robust governance and risk management processes. The value we create We deliver value for our stakeholders, which include our customers, as well as financial value for shareholders, by: • operating within our regulatory frameworks thereby being efficient and compliant; • performing well against our regulatory incentives, delivering customer benefits and good returns; • managing our cash flow requirements and securing low-cost funding; and • maintaining a disciplined approach to investment in our networks. 4

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Business Model: How we operate What we rely on Internal resources Strong relationships Physical assets Customers We own electricity and gas networks that In the UK we do not own the energy that flows transmit energy over long distances from through our electricity cables and gas pipes. where it is produced. In the US, we also This energy is owned by our customers, such distribute it locally to where it is consumed. as electricity generators and gas shippers. These networks are built to last for many These industrial customers, together with decades. Such networks account for the vast domestic consumers through a small portion majority of our asset base. We also own three of their energy bills, pay to use our networks. subsea electricity interconnectors, with three In the US, we have nearly seven million further subsea cables under construction as residential and commercial accounts. well as LNG importation facilities. Contractors and suppliers We work in partnership with our supply chain, c.£4.8bn p.a. which has complementary experience, skillsets average investment in our assets over the past and resources. We agree mutually beneficial three years (on a constant currency basis) contractual arrangements and, wherever possible, leverage economies of scale and use Funding sustainable and global sourcing opportunities. We fund our business through a combination of shareholder equity and long and short-term Communities and governments debt. We maintain an appropriate mix of the The societal impact of our activities means two and manage financial risks prudently. that a range of stakeholders have a legitimate interest in and influence on the work we do. These include national and regional 63% governments, local communities, our supply regulatory gearing (net debt as a proportion chain, and business and domestic consumers of the value of regulatory assets and other of the energy we transport. invested capital) Economic, health, safety and Employees environmental regulators Our highly skilled, dedicated employees have We are subject to economic regulation by a strong public service ethos. They manage bodies that are entirely independent of the and maintain the physical energy infrastructure, Company. These economic regulators set and assist and develop the many stakeholder the prices we can charge for providing an relationships that are crucial to the Company’s economic, efficient and non-discriminatory success. service. Our regulated revenue therefore covers day-to-day running costs, financing As we support the changes needed to build capital expenditures to renew and extend our a net zero energy system, we are providing networks, and incentives or penalties relative employment opportunities and supporting to performance targets. It also affords our our workforce to build the skills necessary shareholders a fair return on their investment. to support these changes. By attracting and retaining the people capable of supporting The energy we transport and the activities we the journey to net zero in the energy sector undertake are intrinsically hazardous; therefore we can help the places we operate reach our operations have to comply with laws and their emissions targets. regulations set by government agencies responsible for health, safety and 23,069 environmental standards. employees worldwide 5

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Business model How we operate continued How we do business Our technical expertise Our culture Over the many decades in which we have National Grid’s culture is the values, beliefs played a vital role connecting people to the and behaviours that characterise our energy they use, National Grid has built safe Company and guide our practices. and reliable networks. We continue in our efforts to develop a well-respected and trusted We are working hard to progress as an reputation for engineering excellence. inclusive employer that values diversity. The knowledge and expertise of our employees We combine our extensive skills, knowledge is fundamental to our business success. and capabilities with innovation to ensure our To enable our employees to reach their full core competencies continuously create value potential, we are investing in building the for shareholders and wider stakeholders alike. skills and capabilities of our workforce. We are recognised for our excellence in: We maintain high standards of ethical business. We also promote the right Asset management behaviours that are aligned with our values and We invest in and maintain our assets across culture by recognising our employees through their life as cost-effectively as possible. a company-wide reward system that supports both what they achieve and how they have Our focus ensures efficient management delivered their achievements. of our assets across their lifetime. 9.0% Strategy and risk Asset growth 2019/20 management Engineering Our strategy places the customer at the heart The skills of our engineers are vital in delivering of our decision-making and consists of three safe, efficient, reliable and sustainable long-term priorities: performance for all our businesses. Our workforce strives to: • optimising our operational performance; • find practical and innovative solutions • growing our core business; and to complex problems; • evolving for the future. • employ risk-based decision-making; and As the energy industry continues its transition • adopt common approaches and to a cleaner future, we have evolved our strategy continuous improvements. so that it clearly articulates our priorities, while positioning our business to continue to deliver Our engineering expertise supports the long-term economic benefits in the regions in delivery of a reliable network. which we operate. Capital delivery The evolved strategy is founded on four We add value for our stakeholders by strategic pillars which are to: ensuring safe and effective delivery of large • enable the energy transition for all; and complex infrastructure projects, ranging from large portfolios of smaller works to • deliver for our customers efficiently; stand-alone mega projects. • grow our organisational capability; and • empower our people for great performance. £5.4bn We have well-established governance structures Capital investment in 2019/20 that include comprehensive risk management, strong controls and financial discipline. Innovation Our innovation activities are focused on future-proofing the business for our customers Further reading as the energy landscape changes. Collaboration About our strategy on pages 16 – 17 and is crucial as we search for new technologies and how it is evolving on page 12. techniques that will support this transformation. Internal control and risk management on We are therefore investing in technologies pages 22 – 25. through our venture capital and innovation arm, Our commitment to being a responsible NGP, while continuing to partner with industry, business on pages 48 – 56. academia, and policymakers. £134m Fair value of NGP portfolio at 31 March 2020 6

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Business model: How we operate The value we create For stakeholders and wider society Society Economic, health, safety and We provide the energy systems that help environmental regulators economies grow in a sustainable, affordable Through constructive, transparent engagement and reliable way. We continue to work with and consistent, reliable delivery of our partners and customers on the technologies commitments, we build trust with our regulators. required to make net zero a reality. 0.12 LTIs 70% (per 100,000 hours worked in a 12-month period) Current reduction in greenhouse emissions Group safety performance 2019/20 Investors Contractors and suppliers We aim to be a low-risk investment proposition, We maintain responsible and efficient supply focused on generating shareholder value chains in which our interests and those of through dividends, supported by asset growth our suppliers are aligned with the interests from investing in essential assets under primarily of customers. regulated market conditions, to servicing long-term sustainable consumer-led demands. £6.0bn 11.7% Group supply chain spend 2019/20 Group Return on Equity 2019/20 Communities and governments We help national and regional governments Our employees formulate and deliver their energy policies We seek to create an environment in which our and commitments. The taxes we pay help workforce can make a positive contribution, fund essential public services. We have an develop their careers and reach their full potential. important role to play in sustainability, enabling the transition to a low-carbon future. 77% Employee engagement score 2019/20 £47m Contribution to communities 2019/20 Customers By delivering the energy they need and dealing with them in a transparent and responsive Further reading manner, we seek to build trusted relationships Our Key Performance Indicators (KPIs) on pages 18 – 20 with our customers as we deliver services Our stakeholders on pages 44-47 to them. Our commitment to being a responsible business on pages 48 – 56 Financial value The chart below describes how our businesses create financial value. Further detail can be found in our financial review on pages 28 – 37. Revenue and profits The vast majority of our revenues are set in accordance with our regulatory agreements (see pages 28 – 37), and are calculated based 1 on a number of factors including investment in network assets; performance against incentives; allowed returns on equity and cost of debt; and customer satisfaction. Cash flows Our ability to convert revenue to profit and cash is important. By managing our operations efficiently, safely and for the long term, we generate 2 substantial cash flows. Coupled with long term debt financing, as well as additional capital generated through the take up of the shareholder scrip dividend option during periods of higher investment, we are able to invest in growing our asset base and finance returns through dividends. Investment We invest efficiently in our networks to deliver strong and sustainable growth in our regulated asset base over the long term. We continually 3 assess, monitor and challenge investment decisions so we can continue to deliver safe, reliable and cost-effective networks. Capital allocation Our capital allocation is determined by the need to fund our businesses to deliver the investment and outputs required under our regulatory frameworks in the UK and US. The investments we make in our business seek a balance between growth and cash flow. 7

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Chairman’s Statement “National Grid evolved its vision to reflect our belief that a responsible business needs to stand for something beyond profit.” Sir Peter Gershon Chairman Final dividend of As we all continue to face the unprecedented challenge of COVID-19 around the world, 32.00 National Grid remains committed to doing the p per share proposed to be paid on 19 August 2020 right thing for our employees, our customers, our communities and our suppliers. Full year dividend (pence per share) 48.57 47.34 45.93 44.27* 43.34 Our priority throughout this period continues to be keeping our key workers safe. We have well-developed procedures in place to manage the effect of a pandemic, and we swiftly and successfully implemented our business continuity plans which allowed us to maintain safe working environments for our workforce. That ensured they could play their part in this time of global crisis by keeping our networks running and the energy flowing to hospitals, care homes, businesses and homes. I would like to thank them for their dedication and resilience. 19/20 18/19 17/18 16/17 15/16 In mid-April, after our financial year end, the extraordinary resilience of our US employees also enabled power to be quickly restored to over *excludes a special dividend of 84.375p. 200,000 customers across New York, Rhode Island and Massachusetts following extensive storm damage, despite the additional constraints arising from COVID-19. The Annual General Meeting will be held on Some short-term delay to our capital programmes was inevitable given 27 July 2020. This year, it will be held behind the lockdown measures put in place by governments to control the closed doors as a result of the COVID-19 spread of COVID-19. However, work on our capital programmes has pandemic. More details on how to watch a now resumed. In the US, the suspension of debt collection and customer presentation following the AGM can be found termination activities across our jurisdictions resulted in lower customer on our website: www.nationalgrid.com. collections and additional provisioning for bad and doubtful debts. We are now working diligently to prepare for the future, in which the safety of our employees and customers will remain of paramount importance. The Board’s ongoing priorities are our societal responsibilities, the balance sheet and liquidity. In support of these and in recognition of the uncertainty surrounding the evolution of the pandemic, we are keeping a number of scenarios under regular review. Our current base case assumes a scenario of continued gradual easing of restrictions in all our operating territories, to keep the spread of the pandemic under control. Against that backdrop, I am pleased that we are able to use our extensive resources to help support the communities we serve to get through and recover from the pandemic. Although the Company has implemented a number of measures to limit discretionary external spending, it has not implemented pay reductions, furlough or compulsory redundancy schemes. 8

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Chairman’s Statement Nationalisation We completed the sale of our remaining stake in Cadent in June 2019 The Board spent a lot of time in 2019 considering our response to the for £1,965 million, and the proceeds were reinvested in the business to Labour Party’s proposal to nationalise nearly all of National Grid’s UK support the significant capital investment programme and asset growth assets. We implemented some measures which would have strengthened across the Group over the medium term. our ability to secure a fair price for these assets, should the Labour Party have won the General Election. Although the Conservative Party secured Regulatory issues a majority at this election, we note that the new Labour leader pledged We continue an open dialogue with our regulators. In the UK, we submitted his support for common ownership in a range of sectors, including our final business plans for RIIO-2 in December 2019. energy, in his leadership campaign. We are resuming settlement negotiations in the KEDNY/KEDLI rate The path to net zero cases in the interest of agreeing on a multi-year rate plan that mitigates Our focus for the future is to lead the way in the delivery of a clean bill impacts for our customers while allowing us to maintain safe and energy transition. During the year, National Grid committed to reduce reliable service, advance our clean energy goals, and earn a reasonable its own emissions to net zero by 2050, and we also saw significant return. If we are unable to reach a negotiated settlement, the rate cases legislative action towards a net zero ambition. will continue to a litigated outcome at which time we would then plan to file a new multi-year rate case proposal. The UK and States of New York and Massachusetts each established legally-binding targets to achieve net zero emissions by 2050, while In light of the financial hardships that our customers have experienced Rhode Island maintained its legally-binding target of 80% emission from the COVID-19 pandemic, Niagara Mohawk Power Corporation reductions by 2050. We welcome this progress as it is clear that (NMPC) delayed the implementation of certain previously approved rate decarbonisation and the pathway to reach net zero will remain one of the increases. NMPC also delayed the filing of a rate case this spring and major long-term issues facing our economies. are exploring options including an extension of the current rate plan or a rate case filing later this summer. While the pathway to decarbonisation of electricity has been identified, there is no obvious solution for the decarbonisation of heat. We continue Appointments and Board changes to work with governments and others in the industry to identify solutions, US Executive Director Dean Seavers stood down from the Board for but it is clear that the right regulatory and policy frameworks will be personal reasons in November 2019. The Board appointed Badar Khan, critical to enable a fair and affordable transition to a clean energy future. who was already a member of the Executive Committee, as interim President of the US business. Following a thorough process to identify Reviews a permanent successor, which included both internal and external Although the power outage in Great Britain on 9 August 2019 caused candidates, I’m pleased that Badar was confirmed as President of the significant disruption, the Board is pleased that the subsequent internal US business in April 2020. and external reviews confirmed our systems operated correctly and identified the failure of certain generators and railway assets as the cause. The Board was pleased to welcome two new Non-executive Directors The external reviews highlighted a number of recommendations which during the year – Jonathan Silver, who has a strong background in we hope are implemented to improve the resilience of the overall GB finance and US government policy, and Liz Hewitt, who brings extensive infrastructure in future. The Board believes it is important that the current business, financial and investment experience from international external review of the structure of the ESO results in a stable outcome companies across a range of sectors. which best enables the UK to meet its 2050 net zero commitment. You can read more details of all our Board members’ experience The Board was deeply concerned that the actions taken to implement and the Committees they support in the Corporate Governance review a moratorium on new gas connections in downstate New York resulted in on pages 63 – 107. strong public criticism of the Company by Governor Cuomo, significant reputational damage, difficulties for customers, and a settlement with Culture and Responsible Business the New York Public Services Commission. The Board commissioned The recent tragic death of George Floyd and the subsequent widespread two external reviews which have provided valuable insights into how our expressions of public support for the Black Lives Matter movement have US business got into this situation and a number of recommendations, reinforced the right of everyone to equal opportunities, to have their voice which are being implemented at pace by our new President of the US heard, and to feel safe as they go about their daily life. These recent business. As we continue working with the Public Services Commission events highlight that companies have a vital role to play in addressing to find a long-term solution, we will ensure our approach to meeting inequality and injustice wherever we see it, encouraging our employees increasing demand for energy in New York State takes account of all to speak up, challenge and act where something does not feel right. key stakeholders. We will not condone intolerance of any kind at National Grid. Financial reporting The Board hosted several meetings throughout the year with a The International Financial Reporting Standard (IFRS) technical cross‑section of employees to ensure the voice of the employee requirements make reporting some of the performance measures that was heard by the Board, and was pleased with the effectiveness we use as a regulated business challenging. We provide additional of these sessions. information, on page 32, about both our significant assets and liabilities that do not form part of our audited accounts, to help our investors During the year, National Grid evolved its vision to reflect our belief that gain a fair, balanced and understandable view of our business. a responsible business needs to stand for something beyond profit. Where practicable we reconcile these with our statutory measures We have a responsibility to demonstrate our commitment to society in ‘Other unaudited financial information’ on pages 240 – 249. more broadly, and that’s why our vision is to be at the heart of a clean, fair and affordable energy future. How we generate and preserve value Our purpose and values are key to our Company’s DNA. In particular, Our dividend policy aims to grow the ordinary dividend per share at least they have enabled all our employees to respond with huge commitment, in line with the rate of RPI inflation each year for the foreseeable future. agility and flexibility to the challenges of COVID-19. I am immensely As is usual practice, the Board reviews this policy regularly, taking into grateful to them. account a range of factors including expected business performance and regulatory developments. Following stress testing of the finances of the Company against a number of potential COVID-19 scenarios, the Board has decided to recommend a final dividend in line with this policy. Accordingly, the Board has recommended an increase in the final dividend to 32.00p per ordinary share ($2.0126 per American Depository Share). Sir Peter Gershon If approved, this will be paid on 19 August 2020 bringing the full year Chairman dividend to 48.57p per share ($3.0799 per American Depository Share), an increase of 2.60% over the 47.34p per share for the financial year ended 31 March 2019. 9

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Chief Executive’s review “ National Grid has a leading role to play in ensuring a cleaner energy future in all our regions.” by 2040. Rhode Island maintained a legally binding target to reduce carbon emissions by 80% by 2050 and the Governor signed an executive order targeting 100% renewable electricity by 2030. At National Grid, we have evolved our strategy and vision to reflect our belief that we have a responsibility to ensure that the energy future we help to shape is one where everyone shares the benefits and where we enable the communities we serve to deliver a clean transition. John Pettigrew That’s why our vision is to be at the heart of a clean, fair and Chief Executive affordable energy future. You can read more about our new strategy on page 12. Throughout this report, we have reported our performance We’ve made strong progress against our against the strategy that was effective until 31 March 2020, and which strategic priorities despite a challenging year. is set out on pages 16 – 17. During the year, we committed to reducing our own emissions to net zero by 2050 and to continue to facilitate the industry-wide transition The far-reaching and devastating global consequences of COVID-19 to a low-carbon future. cannot be underestimated and we all owe a debt of gratitude to those who have been on the frontline fighting this virus across the world. We worked with the UK government to accelerate the transition to electric vehicles to cut carbon emissions and improve air quality for At National Grid, our role throughout this crisis has been to play our part communities the length and breadth of the country. We were pleased to in keeping the lights on and the gas flowing. Keeping the networks see a £500 million commitment in the 2020 Budget to support the rollout running, keeping our customers connected to the power they rely on of new rapid-charging hubs so drivers are never more than 30 miles and expect, and protecting the communities where we live and serve from a charging point. has never been more important. We are developing the world’s first zero-carbon industrial cluster in the I’m immensely proud of the way all our workforce have responded to this UK’s Humber region in partnership with Drax and Equinor. The Zero pandemic, and particularly those who go out to work every day in the Carbon Humber consortium will use carbon capture and storage to field and in our control rooms to ensure we continue to power hospitals, create a zero-carbon region by 2040. homes and society during such a challenging period. We are developing hydrogen trials and investing to understand the impact We took immediate action to lessen any financial hardship our of hydrogen on our existing gas assets to address the decarbonisation customers may have faced, suspending debt collection and customer of heat. While gas clearly has a role to play for many years to come, we termination activities across our US jurisdictions, and delaying planned understand the urgency of finding a solution to decarbonise heat in a bill increases in New York State. We have also strengthened customer way that is fair, affordable and not overly disruptive to consumers. support activities to help lower-income customers manage their energy bills during the crisis and beyond. We’ve started construction work on our Viking Link interconnector, connecting Great Britain and Denmark, and continue construction on We donated a total of £600,000 to the National Emergencies Trust, the IFA2 and North Sea Link. Our interconnectors have a key role to play Trussell Trust and University Hospitals Birmingham Charity in the UK, in a decarbonised energy sector, enabling the most efficient use of and $1 million to community-based charities across our US jurisdictions renewable energy across Europe. to provide help and support to the people that needed it most. We also introduced a programme of practical help, encouraging our thousands Delivering for investors of UK employees to volunteer for half a day per week with charities During the year, we spent more than £5 billion growing and enhancing working on the COVID-19 response. our US and UK energy networks, through a combination of organic growth, reinvesting the proceeds from the Cadent sale and innovative We are planning additional support activities for the communities we financing methods such as our green bond. We achieved this strong serve for the post COVID-19 environment, including employability skills performance while also delivering a high level of asset growth of 9%. support and helping small and local businesses in our supply chain. The proposed final dividend of 32.00p, which is still subject to shareholder We recognise that the impact of COVID-19 will be felt over the long term, approval, brings our full year dividend to 48.57p, an increase of 2.60% and we are committed to applying our Responsible Business principles and in line with our policy. This is covered 1.2 times by our underlying for our workforce, our communities and the economy in our response. earnings per share of 58.2p. While the end of the financial year was dominated by responding to the Safety COVID-19 pandemic, 2019 saw uncertainties particularly in the UK where the external environment was dominated by Brexit and a General Election. In the UK and NGV businesses, we’ve seen a strong safety performance this year. We continue to focus our efforts on developing a generative Leading the clean energy transition safety culture, and in the UK we’ve seen our lowest ever number of lost time injuries. It’s been a year of significant progress in the clean energy transition with climate change rising up the agenda for the public and politicians In the US, we’re focused on improving safety and ensuring it is front alike. We’ve seen climate change protests across the world, and an of mind for all our workforce after seeing a deterioration in performance increased commitment from governments to take action, including in over the last 12 months. Tragically, we also had a fatality in the US where the geographies in which we operate. The UK legislated for net zero one of our colleagues was struck by a vehicle which had driven into a emissions by 2050, and New York and Massachusetts each set an clearly marked out area where he was working. economy-wide limit of net zero carbon emissions by 2050, with New York additionally legislating the target of 100% carbon-free electricity 10

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Chief Executive’s review Delivering for our customers IFA2, the 149-mile (240-kilometre) subsea cable between Great Britain Customer performance remains a key metric and I’m pleased we’ve and France is on track to become operational later this year, and work seen a steady increase in our customer satisfaction scores for GT and also continues on our North Sea Link to Norway which is expected to ET. However, our scores were below target in the US, our metering be operational in 2021/22. Construction is now underway on Viking business and the ESO. We have identified areas of improvement and Link, the 472-mile (760-kilometre) subsea cable between Great Britain action has already started to address some of these. and Denmark. Optimising performance Evolving to a low-carbon future We set out our ambition last year to increase efficiency in our UK and US In our role at the heart of the clean energy transition, we have continued regulated businesses, becoming more responsive to customers’ needs, to take action to enable decarbonisation across our business. while also delivering sustainable cost savings. This year we reduced our costs in both regions by significantly more than our £50 million UK target We completed our acquisition of Geronimo, a leading wind and solar and the $30 million US target through a variety of measures including developer in North America, in July 2019. Since the acquisition, careful contract management and negotiation and improving workforce Geronimo has announced the commercial operation of its 200 MW productivity. Removing these costs from our business will help to Crocker Wind Farm in South Dakota, along with the signing of a power minimise future increases to customer bills. purchase agreement with Basin Electric Power Cooperative for its 128 MW Wild Springs solar project, also in South Dakota. In the UK Transmission businesses, the weighted average Return on Equity of 12.4% was maintained and within the 200 to 300 basis points The ESO is also preparing to enable a green energy future and by 2025, outperformance that we committed to under RIIO-T1. In the US, Return aims to have transformed the operation of Great Britain’s electricity on Equity of 9.3% represented 99% of our allowed return, benefiting system so it can operate with zero carbon. from revenues from rate case increases in addition to control of our costs and was up 50 basis points on last year. Our Group Return on I was pleased to note that 2019 was the cleanest year on record for the Equity was marginally lower at 11.7%, down 10 basis points from last UK as, for the first time, the amount of zero carbon electricity used by year, partly due to lower income from our other businesses. the UK’s homes and businesses outstripped that from fossil fuels for a full 12 months. National Grid has continued to deliver world-class reliability and responded well to storms in the US. We were recognised with the EEI’s Emergency As the UK energy industry continues to evolve, we are working closely Assistance Award and the Emergency Recovery Award for our fast and with the government and regulator to review the most appropriate effective response to storms in 2019. In the UK, we regret the disruption structure for the ESO following legal separation last year. caused by the power outage on 9 August 2019 but welcomed the Ofgem and government reports into the incident which confirmed that Unlocking future potential the outage was not caused by National Grid infrastructure. We were I was pleased that our focus on diversity was recognised with Forbes pleased that they agreed with our view that, given an increasingly complex naming us one of the Best Employers for Diversity 2020, and the US and challenging energy network, it is appropriate to carry out a review of Human Rights Company Foundation awarding us Best Place to Work the Security and Quality of Supply Standards. LGBTQ Equality. Our environmental commitments were also recognised with a place for the fourth consecutive year on the CDP A list, which We were pleased with the stakeholder group support we received for names the world’s most pioneering companies leading on environmental the RIIO-2 business plans we submitted in December 2019. The Open transparency and performance. Hearings expected in April 2020 were delayed due to COVID-19, but we continue to work with Ofgem and all our stakeholders to find the most National Grid continues to focus on being a responsible business and appropriate framework to balance the needs of our customers and increasing our positive impact on society. The unprecedented global investors. You can read more about the composition of the stakeholder challenge of COVID-19 demonstrated more than ever the importance of group on pages 45 – 47. being a responsible business, and we concentrated our efforts on how best to support our workforce and our communities through this difficult time. We welcomed Ofgem’s decision to apply the Strategic Wider Works model as part of the RIIO-T1 framework to the Hinkley Seabank Connection In addition to the immediate volunteering programme we set up to Project, which we believe is in the best interests of consumers. support those who needed it most during the COVID-19 pandemic, we partner with charity organisations to encourage and enable our In the US, we secured our Massachusetts Electric rate order with a employees to volunteer with them. In early 2020, we launched a five-year performance-based mechanism and an allowed Return on community investment strategy which will provide access to skills Equity of 9.6%. development for 45,000 people across the US and the UK, as we help to equip future generations to be part of the clean energy transition. In New York, we enforced a temporary gas moratorium in May 2019, which led to a very challenging period for all our stakeholders. We found We invest millions every year in training to ensure our workforce have operational solutions to resolve the issue for the short term and have the skills to meet the changing needs of a net zero economy, as well now submitted our report into long-term solutions to the State of New as supporting STEM-related activities for tens of thousands of York Public Services Commission (NYPSC). We are listening to our schoolchildren around our key infrastructure projects. stakeholders’ concerns and will continue to work with the NYPSC as we try to resolve the issue in the coming months. Looking ahead I’d like to end by expressing my gratitude to all our workforce who have Growing our assets worked tirelessly to achieve the performance we have delivered this We completed the sale of our remaining stake in Cadent for £1,965 million year, and to ensure the networks keep running as efficiently and safely and reinvested the proceeds in our capital investment programme. as ever through unprecedented times. In the US, we invested £3.2 billion in the year on projects including the completion of the Gardenville substation upgrade in West Seneca, New York, which will supply an affordable and reliable source of renewable power for decades to come. We delivered asset growth in the US of 12.2%, up 300 basis points on the prior year. John Pettigrew Chief Executive In the UK, we awarded the £400 million tunnelling contract for our London Power Tunnels 2 project in December 2019. This 20.85-mile (33.5-kilometre), £1 billion link will provide resilience across South London from Wimbledon to Crayford and is due to complete in 2028. Another Scan here to view our video highlight has been the completion of the tunnelling for our Feeder 9 project under the Humber, which has been a critical investment in our gas infrastructure. These are just two of the projects which contributed to capital investment during the year of £1.3 billion and asset growth of 4%. Our interconnector portfolio continues to grow with new subsea power links to France, Norway and Denmark planned over the next four years. 11

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Evolving our strategy for the future We have evolved our strategy in order to better reflect our purpose and Our purpose in response to our business environment. Our purpose remains to Bring Energy to Life, providing the heat, light and power people and businesses rely on and supporting local The evolved strategy reflects a belief that we have a responsibility to communities to prosper. ensure that the energy future we help to shape is one where everyone shares its benefits. We will continue to connect people to the energy they need for the lives they lead, safely, reliably and securely. Vision Values To be at the heart of a clean, Every day we…do the right thing, fair and affordable energy future find a better way and make it happen Bring Energy Strategy to Life Priorities National Grid builds, owns and Enable the energy transition for all operates large-scale, long-life energy assets primarily in networks and Deliver for customers efficiently renewables that deliver fair returns and high societal value. The Company’s Grow organisational capability portfolio of largely regulated assets in stable geographies is underpinned by Empower colleagues for great performance a strong and efficient balance sheet. Our vision Deliver for customers efficiently National Grid stands for more than profit. The Company is committed Providing safe, reliable and affordable energy for customers around the to making a positive contribution to society, whether that’s helping clock, ensuring operational excellence and fiscal discipline in everything the young people of today to become the energy problem-solvers National Grid does, building productive partnerships with regulators and of tomorrow, supporting customers to use energy more efficiently, policymakers, and unlocking real value for customers and the or tackling climate change. communities they live and work in. That’s why the Company’s vision is to be at the heart of a clean, fair Grow organisational capability and affordable energy future, ensuring everyone benefits from the Anticipating and adapting to changes in the energy sector in faster and energy transition, that bills are not a burden for individuals or families, smarter ways, remaining at the cutting edge of engineering and asset and that no one gets left behind. management, and innovating more sustainable energy solutions. Our strategy Empower colleagues for great performance Building diverse and inclusive teams that reflect the communities the National Grid’s strategy is to build, own and operate large-scale, long-life Company serves, attracting the best talent, prioritising learning and energy assets primarily in networks and renewables that deliver fair developing the skills needed now and in the future to accelerate the returns and high societal value. The Company’s portfolio of high-quality, energy transition. low-risk assets in stable geographies is underpinned by a strong and efficient balance sheet. Our values This strategy sets the bounds of National Grid’s business and will ensure As a purpose-led, responsible business, how National Grid delivers for it is set up to play a leading role in the energy future. It will be delivered its customers and communities is as important as what is delivered. through four priorities. Colleagues right across the Company, in the United Kingdom and the United States, are committed to: Our priorities Doing the right thing, keeping customers, communities and the wider We have four strategic priorities to make our purpose possible and public safe. achieve our vision. Finding a better way, delivering excellent performance at best value Enable the energy transition for all and innovating new energy solutions. Fully decarbonising the electricity grid through modernisation, increased flexibility and by connecting renewables quickly and efficiently. Leading Making it happen, with a strong focus on excellence, efficiency the way in the decarbonisation of gas, investing in a range of solutions and results. like renewable natural gas, blending hydrogen in networks and carbon offsetting. Decarbonising transport by building electricity network flexibility and supporting charging infrastructure. 12

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Our business environment As well as managing through the COVID-19 pandemic, our societal ambition remains to achieve net zero, with emphasis on fairness and affordability, digitalisation and decentralisation during the transition. 2019/20 developments Our response Climate risk continues to rise up the • In both the UK and US, we are taking important steps to address the future corporate agenda, against the rapidly of heat, engaging across the industry and with government and regulatory evolving societal attitudes to climate bodies. In the US, we collaborated with industry partners to develop change and the role of energy companies interconnection guidelines for renewable natural gas (RNG) in New York in leading and meeting net zero State that seek to facilitate growth of this clean energy resource. In the UK, commitments. we have conducted three feasibility studies on the potential role of Net zero hydrogen and how our networks could facilitate its uptake. 2019 was a turning point for climate At least 9 countries have legislated or • For our UK regulated business, the single biggest contributor towards action, from protests on the street to are in the process of legislating, and our net zero target to reduce is Sulphur Hexaflouoride (SF6), and we will be legislative action. Governments at least 112 countries are discussing around the globe are considering leaders here. In the US, through our gas pipeline replacement programme, legislating, net zero targets by 2050 we replaced 460 miles (740 kilometres) of pipe in 2019/20, reducing and acting on ambitious carbon or sooner. reduction targets. greenhouse gas emissions from the unintended release of natural gas. UK • The ESO has agreed contracts with five parties, worth £328 million over a six-year period, in a world-first approach to managing the stability of the The UK became the first major electricity system. This aids our ambition to be able to operate GB’s economy to commit to a legally electricity system carbon free by 2025. binding target of net zero emissions 70% • The world’s largest offshore wind farm, the 1.2 GW Hornsea Project One by 2050. National Grid’s reduction in carbon wind farm, is connected to our electricity transmission network and first emissions since 1990. 2019 was the cleanest year on record generated power in 2019. for the UK as, for the first time, the • In January 2020, we announced the launch of our first ever green bond. amount of zero carbon electricity used Raising approximately €500 million, the bond’s proceeds will finance or by the UK’s homes and businesses refinance UK electricity transmission projects with environmental benefits. Net zero outstripped that from fossil fuels for • We have partnered with Drax Group and Equinor to explore how large-scale a full 12 months. by 2050 carbon capture usage and storage and hydrogen could convert the UK’s Humber region into the world’s first net zero carbon industrial cluster. Our net zero commitment is to reduce US our own greenhouse gas emissions to • New York Transco, a joint venture in which NGV is a partner, was selected The states of New York and to develop the New York Energy Solution transmission project, unlocking net zero by 2050. Massachusetts each set an renewable energy upstate for customers downstate. economy-wide limit of net zero carbon The future of heat • NGV completed its acquisition of Geronimo, a leading US onshore wind and emissions by 2050, with at least 85% solar developer, to establish a foundation on which to grow a large-scale In the absence of both clear of reductions from their states’ own renewables business, such as the 200 MW Crocker Wind Farm in South technology roadmaps and public energy and industrial emissions (and Dakota. The £209 million deal also secured a controlling share of a 379 MW policy frameworks that underpin the the remainder possible via carbon solar and wind generation joint venture, Emerald Energy Venture LLC decarbonisation of heat by 2050, we offsets). New York additionally (‘Emerald’), with Washington State Investment Board. currently continue to believe that our legislated the target of 100% gas assets will have useful purposes carbon-free electricity by 2040. • Interconnectors played an important role in helping the UK use more zero beyond 2050. In common with the carbon electricity than that from fossil fuels, and we are currently Committee on Climate Change’s Net Rhode Island maintained a legally constructing three additional interconnectors: IFA2 to France, North Sea Zero report in May 2019, we believe binding target to reduce carbon Link to Norway and Viking Link to Denmark. that the future of heat is one reliant on emissions by 80% below 1990 levels • We believe our gas businesses can facilitate the transition to a multiple technologies and fuels, with by 2050, and Governor Raimondo decarbonised gas system and are investing in solutions such as renewable an enduring role for natural gas. signed an executive order targeting natural gas and blending hydrogen in our network. However, the scale and purpose 100% renewable electricity by 2030. • We have committed to meeting the Task Force on Climate-related Financial for which the networks will be used Disclosures (TCFD) recommendations in full (see pages 57 – 62). is dependent on technological Across the wider US, one in three developments and, crucially, Americans – more than 110 million policy choices of governments people – live in a community which and regulators. has committed to or achieved a 100% clean electricity target. The future of heat is uncertain, and its decarbonisation is reliant on relatively nascent technologies, such as hydrogen and carbon capture usage and storage, as well as biogas and heat pumps. These new and evolving technologies will need to be used in new contexts and on a scale that has not yet been demonstrated. We do not believe that any of these technologies can, in the next 30 years, reach sufficient scale to represent an existential threat to our gas businesses. 13

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Our business environment continued 2019/20 developments Our response UK • Our US and UK regulated businesses are pushing for greater affordability Cost of energy remains a key priority, and innovative ways to minimise the total cost of energy to consumers. evidenced by 2019’s implementation • In the UK, we have generated £603 million of savings for consumers of the energy price cap, and two of in the first seven years of the RIIO arrangements, excluding any share Ofgem’s key priorities: to ‘drive down from Cadent. Fairness and prices’ and ‘decarbonise to deliver a • Our £150 million Warm Homes Fund has helped over 42,000 households Affordability net zero economy at the lowest cost suffering from fuel poverty access heating systems and become more to consumers’. energy efficient. This is the largest private sector investment in energy National Grid delivers energy safely, efficiency ever made in the UK. reliably and affordably to the With the government’s recent • Our utility energy efficiency programmes continued to deliver excellent communities we serve. As well as commitment to net zero, industry affordability, we will play our role results for US customers, achieving annual electricity savings equal to 3.7% participants and advisors, such as of sales in Massachusetts and 1.1% in New York. All three states that we in ensuring that no one is left behind the Committee on Climate Change, in the short term during the COVID-19 serve rank in the top five in energy efficiency performance nationally have stressed the importance that according to the ACEEE. crisis, or in the longer-term transition net zero is delivered in a fair way as to clean energy. a ‘just transition’ across society, with • In response to the COVID-19 crisis, we have expanded customer support, vulnerable consumers protected. paused late payment collections activities, and placed a freeze on related service cutoffs. US • In our Massachusetts Electric Company rate order, we gained approval #1 Energy costs remain a priority for for our proposed five-year forward-looking ratemaking mechanism that consumers and regulators, and includes a consumer dividend and earnings sharing mechanism that The US national ranking of our rewards efficient company performance. Massachusetts Electric utility energy fairness is high on the agenda in the discussion about decarbonisation • In upstate New York, we delivered an estimated $200 million in net societal efficiency programme by the pathways and their associated costs. benefits in our second year of performance incentives. Such benefits American Council for an Energy- increase the affordability of energy and were achieved by reducing electric Efficient Economy (ACEEE). State regulators continue to explore system peak to mitigate supply costs, increasing adoption of energy innovative regulatory frameworks efficiency and facilitating uptake of heat pumps for beneficial electrification, that reward utilities for managing among other initiatives. customer bill impacts, while delivering • In Albany, New York, we worked with the public transit authority to launch 3% desired regulatory and policy four electric buses to test customer experience with the technology and outcomes. This includes adjustments enable expansion to other fleets across our territory. This is an example of UK transmission network costs per to the cost‑of‑service model that our efforts to make electric transport options more widely accessible to all. average household dual fuel bill. are more forward-looking, and which establish new shareholder incentives for cost efficiency. UK • We are supporting growth in distributed energy resources (DERs) in our US Last year 29% of generation was service territories, where our US regulated business connected 314 MW of connected at the distribution network generation in calendar year 2019. We also made investments in the grid to level or behind-the-meter. The July enable future growth, including to increase distribution system capacity and 2019 Future Energy Scenarios (FES) to deploy advanced communications, monitoring and controls technologies Decentralisation document suggested that by 2050 essential to enhanced DER integration. The energy system continues its this could rise to 58%. This is driven • We continued our partnership with leading home solar panel and battery transition from high to low carbon. by new technology and business storage company, Sunrun, securing new contracts for grid services from This change coincides with a shift models enabling solutions such as rooftop solar and storage across the US, with nearly 40 MW capacity and to more decentralised generation, solar panels, electric vehicles and ancillary services in calendar year 2019. including renewables and battery battery storage to be more accessible • Our ‘bring-your-own’ device demand response programme expanded in storage. As the volume of this to all consumers. Massachusetts and Rhode Island and received the Energy Storage North intermittent and distributed generation America (ESNA) Innovation Award and the Peak Load Management Alliance increases, a more resilient and flexible US (PLMA) Program Pacesetter Award. It enables residential customers to system will be required; one that Distributed energy resource receive a financial incentive for enrolling their devices to be managed by us makes best use of available energy investments and installations to create grid flexibility. resources to meet consumers’ needs continue to grow across the US. • Since the start of financial year 2019/20, ET continues to process or has in a balanced, efficient and This includes not only small-scale processed 207 connection applications, of which 20% have been made for economical way. solar photovoltaics, but also electric transmission connected batteries, and a further 14% have been made up of vehicles, distributed storage and a new customer type, where the customer mixes their generation make-up, demand-side resources. Utilities for example solar with batteries. across the country are exploring • The ESO is working on a £10.3 million innovation project to explore how 6 MW how to integrate these resources DERs can be used to restore power in the highly unlikely event of a total or into the grid, ensuring their utilisation partial blackout of the UK electricity transmission network. 48 MWh is effective, safe and reliable. The largest battery storage facility in northeastern US was installed by National Grid on the island of Nantucket in 2019 as a flexible and reliable alternative to undersea cables. 14

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Our business environment 2019/20 developments Our response In 2019, the application of digital • For our digital transformation, we are adopting a Group-wide centralised technologies across the energy hub model supported by regional delivery. Strategy for the transformation industry continued at pace globally. is formed centrally with regional autonomy. Bloomberg New Energy Finance • We expanded a personalisation platform to serve more than two million tracked 379 applications, projects, customers in Massachusetts and Rhode Island. Advanced data and Digitalisation partnerships and product developments analytics proactively identify eligible customers and present the next best Businesses and lives are being for industrial digitalisation. This is 78% offer to individuals, increasing offer enrolment and reducing bad debt. transformed by innovations such as more than in 2018, and they expect a further increase in activity in 2020, as • ConnectNow, our ET network connections project, will improve the artificial intelligence and virtual reality. customer experience of connecting to the network. Focusing on small The energy landscape has seen many positive results of digitalisation drive its increased use. scale connections such as solar, storage, electric vehicle charging and data changes as companies look to create centres, this digital platform assists customers through the application new business models and reduce energy process, providing transparency and facilitating communication. Utility networks in all geographies prices through digital technologies. • We are harnessing advances in digital technology and innovation to Technology commercialisation, consumer are identifying significant potential for their businesses through digital improve business performance. For example, the ESO in collaboration with demand and regulatory stimulus will the Alan Turing Institute has used data science and machine learning to continue to drive these trends. transformations. Advances in technologies to operate systems, deliver a 33% improvement in solar forecasting. This will help the ESO run manage assets and engage with the system more efficiently, and enable more solar capacity to be customers will be a key facet of our connected and utilised. business going forward. • In 2020, the ESO launched a free Carbon Intensity application, aimed at >80% empowering people to make conscious decisions about how they consume The reduction in the US call centre energy by showing them the greenest times of day to use electricity. volume during major storms, after • NGP invested in Dragos, a leading cybersecurity provider of industrial implementing proactive two-way control systems and operational technology. Our cybersecurity team outage texting to improve conducted a pilot of Dragos’ asset identification, threat detection and response software platform to help secure National Grid’s critical communications with customers infrastructure in the UK and US. about service outages and • Dragos was among eight new investments and six follow-on investments restoration. made by NGP, whose portfolio at the close of the fiscal year comprised 21 investments at a fair value of £134 million ($167 million). Our response to COVID-19 Case study – NGV COVID-19 is affecting countries, communities, supply chains and Our response to COVID-19 in our communities markets, including the UK and our service territory in the US. Since the NGV has helped the University Hospitals Birmingham (UHB) Charity to World Health Organisation declared the outbreak as a pandemic on launch a special appeal, to raise £1 million to support patients and staff 11 March 2020, National Grid has applied UK and US Federal and State through the COVID-19 pandemic. government advice and guidance on dealing with the potential and actual spread and impact on our business and our customers. The donation has been used to purchase almost 400 tablet computers that will be used by patients to help them speak to their loved ones while The Company has successfully activated its crisis management they are in isolation. The tablets will be distributed across the UHB Charity’s framework which includes identifying the areas that are deemed critical five hospitals, including the Nightingale Hospital, which has recently been and the corresponding level of reliability and service continuity needed established at the National Exhibition Centre in Birmingham, UK. to deliver normal services during the pandemic. Our plans include continued safe and reliable service during large numbers of workforce absence due to illness. Under government guidelines in both the UK Scan here for the full story. and the US, utility workers are identified as key/essential workers and have been subject to specific guidance and permissions on family arrangements and movements. We have moved to working from home arrangements, where possible, and have also identified critical areas including control rooms, call centres, dispatch and key sites including generation and LNG facilities, terminals, substations and compressor stations. For all these activities plans are in place to maintain critical safety and maintenance activities, which includes sequestering some employees. Some of our work, especially in the US, requires contact with members of the public. To safeguard our employees and the public we are following government requirements and recommendations for social distancing. This includes our collections, meter installations and shut-off arrangements while continuing to provide a safe and reliable network. We have also made arrangements to ensure that those customers with financial difficulties who cannot make payments do not have services cut off. Finally, we are also working with our supply chains so that our systems and networks have the necessary materials and parts. Our regular engagement with government agencies and our regulators, as well as following all advisory services regarding management of the spread of COVID-19, is expected to continue for the foreseeable future. 15

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Delivering against our strategy Our strategy in 2019/20 focused on three strategic priorities for our business, delivering for customers safely and efficiently today while setting a growth pathway for the future. Customer first We have a vital role to play in enabling customers to benefit from the changes in our industry. The clean energy transition and associated technological advancements mean we can provide our customers with a more cost-effective service, while leaving no-one behind. We measure customer satisfaction as a KPI within each of our business segments. 16

National Grid plc Annual Report and Accounts 2019/20 Strategic Report | Delivering against our strategy Our three strategic priorities Examples of progress in 2019/20 1. Optimise performance • Continued the transition begun through our UK and US programmes Our customers want us to be more efficient to make their to leaner and more efficient operating models in the UK and US core energy more affordable, so we must find ways to improve businesses; how we run our business. • Submitted price controls for the UK electricity, gas and system operator business as part of RIIO-2; We need to enhance the customer experience and our productivity through • Received authorisation of a new five-year rate plan for our electric more efficient and customer-focused processes. Given the scale of our distribution companies in Massachusetts; and core business in the UK and US, even small improvements will have a • Continued embedding our Business Management System (BMS) huge impact on our overall performance. Finding new ways of optimising across the Group by publishing BMS standards through the operations will be an important factor in our ability to compete and grow. employee handbook, the National Grid Book, in order to increase standardisation across business activities. 2. Grow core business • Grew our UK and US regulated businesses capex to £5.4 billion ; Delivering strong operational performance provides a • In January 2020 we celebrated the completion of the new, three-mile foundation from which we can invest in our core business (five-kilometre) Humber Tunnel that will house a key gas pipeline and pursue other opportunities. between Yorkshire and North Lincolnshire; • Interconnectors IFA2, Viking Link and North Sea Link are under In the US and UK, we continue to look for business development construction and are on track to be delivered to plan; and opportunities that are close to our core business. • Delivered the largest battery storage facility in the northeastern US on Nantucket as a flexible alternative to undersea cables. In NGV, we will build on our successful efforts to pursue opportunities in interconnectors and large-scale renewables. 3. Evolve for the future • Following legal separation on 1 April 2019, this is the first year We need to future-proof our business against the effects the ESO operated as a separate entity from the UK electricity of a changing energy landscape. Our networks are already transmission company, evolving for its customers and stakeholders; managing changes to the generation mix, while the needs • We are expanding a software platform using advanced data and analytics to proactively identify and present offers to customers and expectations of our customers are evolving. in Massachusetts and Rhode Island; Our preparations for the future are underway. For example, at NGV this • NGP, launched in 2018, growing with a portfolio fair value of £134m collaboration brings together our non-network businesses to focus on at 31 March 2020; and targeted investment in the energy sector outside of our core business. • NGV completed the acquisition of Geronimo, a developer of wind and solar generation. We are also looking to develop new capabilities that are essential for long-term success. For example, NGP is increasing our capability in new Further reading and disruptive energy technologies to meet the changing needs of our See more on these in the Principal customers and communities. Operations sections on pages 38 – 43 17

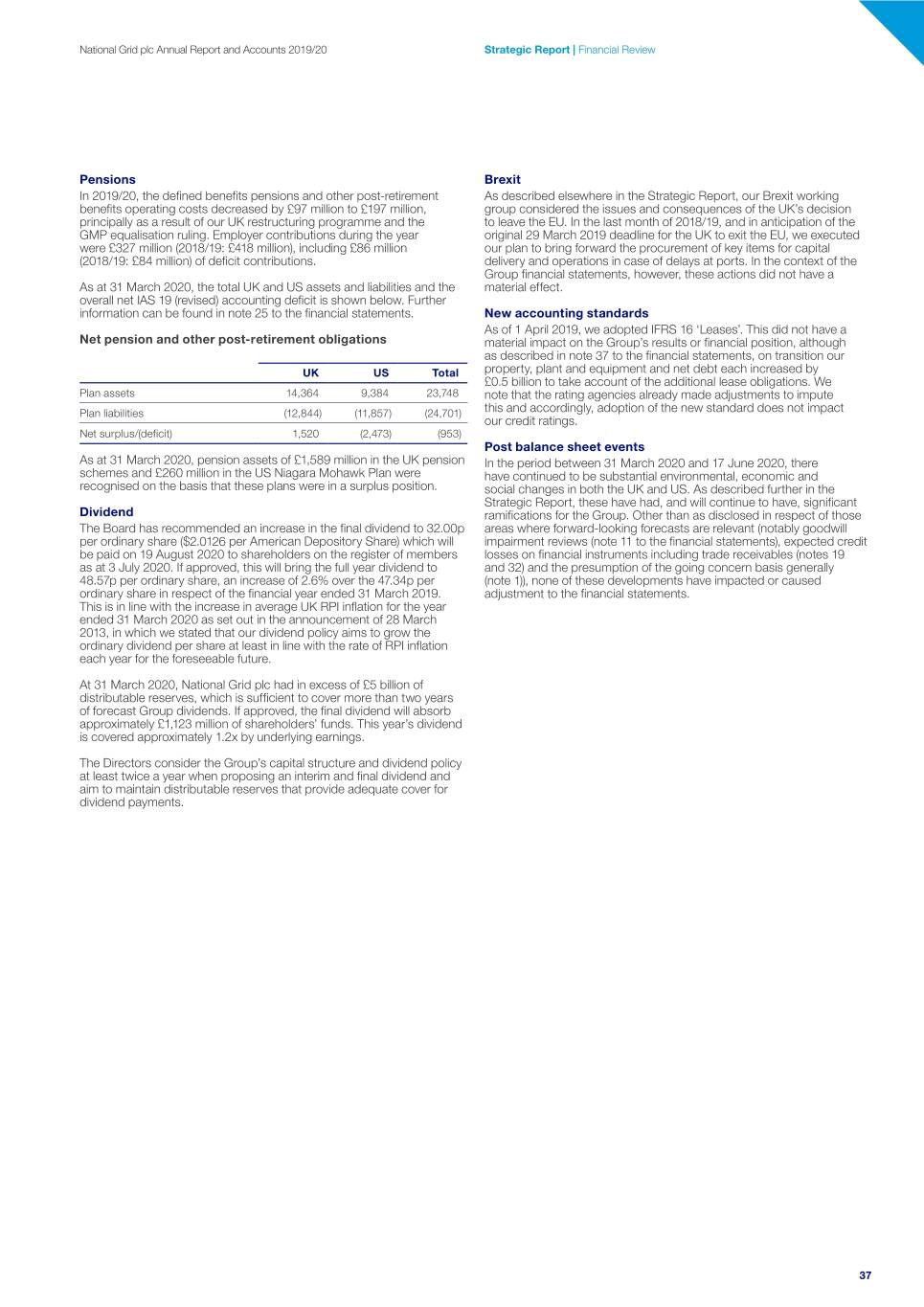

National Grid plc Annual Report and Accounts 2019/20 Strategic Report Progress against our strategy The Board uses a range of metrics, reported periodically, against which we measure Group performance. These metrics are aligned to our strategic priorities. Performance reported in this section is based on the strategy that is outlined on pages 16 – 17. We report our performance measures Link to strategy as follows: Optimise Grow core KPIs performance business • Principal measures that track individual progress against each of our three strategic priorities. See below. • Non-financial measures that underpin delivery of all Evolve for Indicates an alternative three strategic priorities. See below. the future performance measure Other performance indicators • Financial measures that result from the delivery of our strategic Link to remuneration priorities are set out in our financial review, on pages 28 – 37. Remuneration of our Executive Directors, and our employees, is aligned to • Business-unit-level measures that are specific to our three strategic successful delivery of our strategy. We use a number of our KPIs as specific priorities. These are set out within our Principal Operations review, measures in determining the Annual Performance Plan (APP) and Long on pages 38 – 43. Term Performance Plan (LTPP) outcomes for Executive Directors. While not explicitly linked to APP and LTPP performance outcomes, the remaining KPIs and wider business performance are considered. For further detail, please see our Directors’ Remuneration Report, on pages 88 – 107. Principal measures Strategy link KPI and performance Progress in 2019/20 Group Return on Equity (RoE, %) 12.3 The UK regulated businesses delivered a weighted average RoE 11.7 11.8 We measure our performance in generating value of 12.4%, consistent with the return achieved in the prior year. for shareholders by dividing our annual return by our US RoE increased to 9.3% (2018/19: 8.8%), with increased equity base. This calculation provides a measure of revenues from new rates driving improved US regulatory whole Group performance compared with the performance. Group RoE of 11.7% was marginally lower than amounts invested in assets attributable to equity 2018/19 (11.8%), with benefits arising in the prior year from the shareholders. Fulham property sale and US legal settlements. Target: 11–12.5% each year 19/20 18/19 17/18 Customer satisfaction Our UK customer satisfaction (CSAT) KPI comprises Ofgem’s We measure customer and stakeholder satisfaction, while also maintaining electricity and gas transmission customer satisfaction scores. engagement with these groups and improving service levels. Figures represent our baseline targets set by Ofgem for reward or penalty under RIIO (maximum score is 10). We have seen a steady increase in CSAT for GT, through our efforts to 2019/20 2018/19 2017/18 Target understand the impact that our actions have with a particular UK Electricity Transmission (/10) 8.2 7.9 7.7 6.9 focus on responding to their queries. In the first year post separation from ESO, we have also focused on building direct UK Electricity System Operator (/10) 7.6 – – 8.1 relationships with our ET customers, to understand the experience they need us to deliver and redesigning our service UK Gas Transmission (/10) 8.0 7.8 7.6 6.9 accordingly. Due to legal separation in April 2019, the scores also reflect the independent ESO result. The ESO CSAT score US Residential – Customer was below target for the year 2019/20 and we have identified Trust Advice survey (%) 59.8 58.7 56.6 61.6 query response times and tailoring communications as improvement areas for the next 12 months. Action has already Metering NPS score (index) +40 +44 +39 – begun to take place within the value streams to address these areas and they will form part of new insight plans for the ESO in 2020/21. The US metric measures customers’ sentiment with National Grid by asking customers their level of trust in our advice to make good energy decisions. The metric, which is tied to the value customers feel they receive from National Grid, has improved over the past few years yet was below target in 2019/20. NPS scores reported represent the Metering business. Although the score has dropped since 2018/19, we have identified areas of improvement, for example, making sure metering queries raised by our customers are progressed more efficiently. 18